We’ve been hearing whispers about pint-sized nuclear reactors for years now—so, where are they?

Meet the small modular reactors (SMRs), the potential game-changers in nuclear energy that might just be built faster and cost less. For over ten years, the buzz has been that these little reactors could play a big role in the future of nuclear power.

Their compact size means SMRs could dodge many big problems faced by traditional nuclear power, promising not just speedier and more budget-friendly construction but also safer operations.

And it looks like that future is inching closer.

Just recently, NuScale, an Oregon-based company, hit some pretty major milestones for its upcoming SMRs, even snagging the final thumbs-up from the U.S. government for its reactor design. While NuScale is leading the pack, others like Kairos Power and GE Hitachi Nuclear Energy aren’t far behind in the race for commercial SMRs.

NuScale’s design is the first of its kind to clear such a crucial regulatory step, paving the way for construction in the U.S.

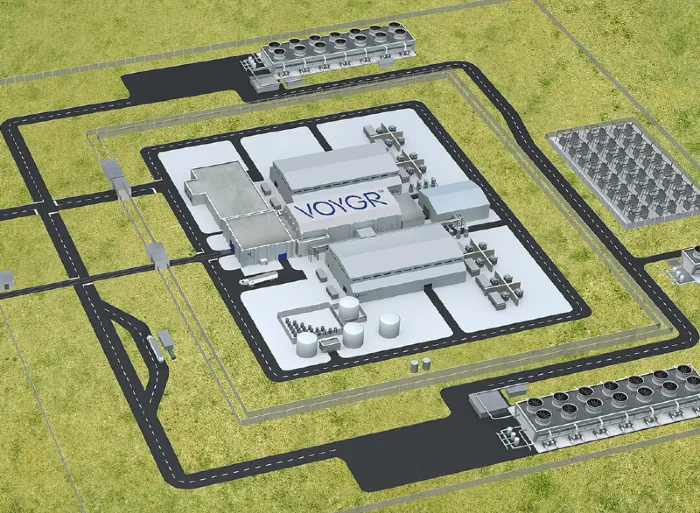

Imagine power plants that aren’t just easy to build and manage but also friendly to our planet, potentially replacing the old, polluting coal-fired ones. That’s the dream with SMRs like what NuScale plans to bring to the table.

However, even with the promise of speeding up nuclear construction, getting to this point hasn’t been a walk in the park. It’s been a journey marked by delays and rising costs. And for NuScale, there’s still a long road ahead to streamline the process enough for these nuclear power solutions to be rolled out quickly and effectively.

Shrinking the Size, Amping Up the Potential

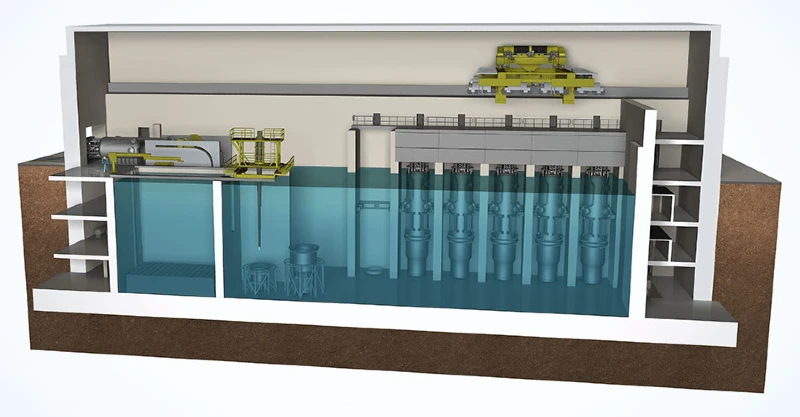

NuScale is switching things up in the nuclear power game by thinking small. Their small modular reactor (SMR) works pretty much like the nuclear giants we’re used to, splitting atoms to get hot and steamy, which then spins a turbine to light up our lives. But here’s the kicker: these reactors are way smaller.

Back in the day, building a nuclear plant was like constructing a pyramid—a monumental task with a price tag in the billions. Patrick White from the Nuclear Innovation Alliance puts it simply: cross the billion-dollar mark, and projects tend to go sideways.

Take Georgia’s Vogtle power plant expansion, for example. They’re adding two giant reactors, each with enough juice to power a million homes. But there’s a catch: they were supposed to be up and running by 2017. Spoiler alert: they’re not, and the budget has ballooned to $30 billion.

NuScale, on the other hand, is dreaming smaller with reactors that pack less than 100 megawatts each. String a few together, and you’ve got a power plant that can compete with a single Vogtle unit, lighting up hundreds of thousands of homes without hogging land—just 65 acres, to be exact.

This shift to mini nuclear plants could be a game-changer. It’s like moving from tailor-made suits to off-the-rack: faster, cheaper, and just as good. In terms of the smaller, more controllable size of the project, Jacopo Buongiorno, director of the Center for Advanced Nuclear Energy Systems at MIT, said, “That’s the benefit—it becomes more of a routine, more of a cookie-cutter project.”

Plus, these pint-sized powerhouses could be safer. Fewer moving parts and simpler safety systems mean less can go wrong. In a nutshell, NuScale’s tiny reactors could be the next big thing in clean, cost-effective power.

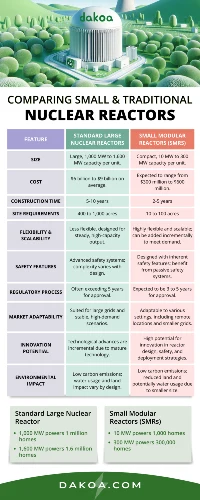

Standard Nuclear vs Small Modular Reactors Comparison Chart

Feature

Standard Large Nuclear Reactors

Small Modular Reactors (SMRs)

Size

Large, 1,000 MW to 1,600 MW capacity per unit.

Compact, 10 MW to 300 MW capacity per unit.

Cost

$6 billion to $9 billion on average.

Expected to range from $300 million to $600 million.

Construction Time

5 to 10 years, depending on the project scale and complexity.

2 to 5 years, benefiting from modular construction and prefabrication.

Site Requirements

Requires large land areas, 400 to 1,000 acres.

Typically requires 10 to 100 acres, depending on configuration.

Flexibility & Scalability

Less flexible, designed for steady, high-capacity output.

Highly flexible and scalable; can be added incrementally to meet demand.

Safety Features

Advanced safety systems; complexity varies with design.

Designed with inherent safety features; benefit from passive safety systems.

Regulatory Process

Longer due to scale and complexity, often exceeding 5 years for approval.

Streamlined in theory, but actual timelines vary; expected to be 3 to 5 years for approval.

Market Adaptability

Suited for large grids and stable, high-demand scenarios.

Adaptable to various settings, including remote locations and smaller grids.

Innovation Potential

Technological advances are incremental due to mature technology.

High potential for innovation in reactor design, safety, and deployment strategies.

Environmental Impact

Low carbon emissions; water usage and land impact vary by design.

Low carbon emissions; reduced land and potentially water usage due to smaller size.

Navigating the Regulatory Maze Of Mind-Boggling Bureaucracy

The journey towards realizing the full potential of small modular reactors (SMRs) has been a winding path, filled more with promise than concrete achievements. While some global initiatives have taken significant strides—like China’s pioneering move to connect an SMR to its grid in 2021—the U.S. landscape remains barren of operational SMRs, primarily due to the dense forest of regulatory procedures managed by the Nuclear Regulatory Commission (NRC).

In the U.S., nuclear power is unique, being the only energy source with its dedicated regulatory body. This distinction ensures unparalleled scrutiny, as Kathryn Huff, Assistant Secretary for Nuclear Energy at the DOE, points out: “These are big, complicated projects.” The Department of Energy (DOE) backs SMR projects with funding and research but does not meddle in regulatory affairs.

The regulatory odyssey for NuScale began in earnest in 2008, reaching a pivotal moment in 2020 with a design approval that cost the company a hefty $500 million and required the submission of around 2 million pages of documentation. “It is a big deal and should be celebrated as a milestone,” acknowledges Jacopo Buongiorno, underscoring the significance of NuScale’s achievement in receiving the NRC’s final ruling on its reactor design.

However, the plot thickens as NuScale aims to enhance its reactor modules. During the regulatory journey, the company discovered its reactors could be more powerful than initially thought. “We found that we could actually produce more power with the same reactor, the same exact size,” reveals Jose Reyes, cofounder and Chief Technology Officer at NuScale. This revelation led to plans for a first power plant at the Idaho National Laboratory with six reactors capable of 77 MW each, totaling 462 MW.

Yet, embracing this advancement means revisiting the regulatory drawing board. NuScale has resubmitted plans for these more potent reactors, potentially adding another two years to the approval timeline. As Reyes suggests, the journey towards innovation in nuclear power is both promising and painstaking, highlighted by regulatory challenges and the relentless pursuit of improvement.

Facing the Future with Caution and Hope

When 2017 rolled around, NuScale had ambitious plans for its Idaho power plant, eyeing 2026 as the year it would start powering homes. Fast-forward, and that dream has been nudged to 2029.

But it’s not just the timeline that’s shifted; the cost of bringing this vision to life has soared, too. Earlier this year, NuScale adjusted its electricity price forecast for the Idaho project from an initial $58 per megawatt-hour to a steep $89. This adjustment places NuScale’s power at a higher cost bracket compared to contemporary sources like solar, wind, and most natural gas plants.

In truth, the price hikes would be even higher if not for substantial federal investment to the tune of over $1 billion already contributed by the Department of Energy, alongside incentives such as the $30/MWh credits under the Inflation Reduction Act.

Rising costs aren’t unique to NuScale, as inflation and higher interest rates bump up expenses for large-scale construction across the board. Yet, as Jacopo Buongiorno points out, this is a common narrative for pioneering engineering efforts: “These initial units will always be a little bit behind schedule and a little bit above budget.” This blend of optimism and realism highlights the delicate balance between innovation and practical challenges.

The path ahead for SMRs is fraught with uncertainty, with the potential for backers to withdraw if costs continue to escalate, underscoring the precarious nature of groundbreaking projects. Buongiorno encapsulates this cautious optimism, “I’m not going to believe it’s for real until I see them operating.”

More To Discover

- The 10 Most Fascinating New Species Discovered in 2023 (Out Of 815)

- Soil Crisis in the Mediterranean: A European Wake-Up Call For Everyone

- Pioneering Anti-Aging Pill for Dogs Begins Trials, with 11-Year-Old Whippet Boo Leading the Pack

- Al Dhafra Solar Farm: The World’s Largest Single-Site Solar Farm Shines On The UAE’s Renewable Energy Ambitions

Kathryn Huff from the DOE echoes this sentiment, suggesting that the true value of SMRs will emerge only after the construction and operation of subsequent reactors. This iterative process, learning from each build, is vital for realizing the potential of SMRs. “It becomes truly real when electrons go on the grid,” Huff asserts, pinpointing the moment of truth when SMRs transition from theory to tangible contributors to a fossil fuel-free future.

This final stretch of NuScale’s journey underscores the broader challenge of innovating within the energy sector: the balance between groundbreaking technology and the economic and logistical realities of bringing such innovations to market.