In a groundbreaking development, scientists have achieved a remarkable breakthrough in harnessing uranium from the vast expanses of our oceans, offering an exciting prospect for a sustainable future in nuclear power generation. Oceans, which blanket the majority of our planet’s surface, have long been home to a reservoir of uranium ions, and tapping into this abundant resource could revolutionize the way we meet our energy needs.

Traditionally, uranium has been extracted from terrestrial sources, primarily rocks and ore deposits. However, these land-based reserves are limited and will eventually be exhausted, not to mention the damage left behind by any mining operation.

Now, in comparison, the potential lurking beneath the sea is staggering, with an estimated 4.5 billion tons of uranium ions dissolved in seawater, a thousand times more than what is available on land, according to estimates by the Nuclear Energy Agency.

Let’s take a quick break and do a quick cost check here! Throughout 2023, the global average price for a pound of uranium was around $57 U.S. dollars.

Doing a little math here that, at $57 per pounds and 4.5 billion tons of uranium floating around in the ocean in microparticles and with 2,000 pounds in a US ton… that means at the average 2023 value of a pound of uranium the ocean is holding $565.48 trillion dollars of uranium. Putting that in perspective, the US total economy is valued at $26.24 trillion for 2023.

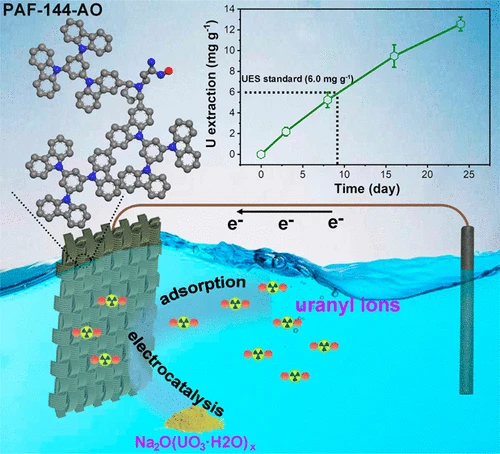

The challenge, until now, has been finding effective methods for extracting these elusive ions from seawater. Conventional materials have fallen short due to their limited surface area, rendering them inefficient for this task. Enter Rui Zhao, Guangshan Zhu, and their team of innovative researchers, who have developed a groundbreaking electrode material designed to attract and capture uranium ions from seawater more efficiently than any existing methods.

Their ingenious solution involves starting with a flexible cloth woven from carbon fibers, which serves as the foundation for their electrode material. The cloth is then coated with two specialized monomers and polymerized.

To enhance its uranium-capturing capabilities, the cloth is further treated with hydroxylamine hydrochloride, introducing amidoxime groups to the polymers. The natural, porous structure of the cloth provides numerous microscopic pockets where these amidoxime groups can nestle, making it a perfect trap for uranyl ions.

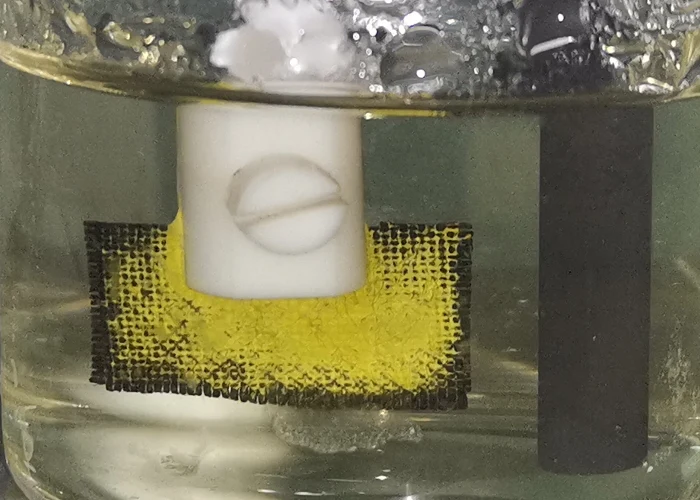

In laboratory experiments, the researchers placed the coated cloth as a cathode in seawater collected from the Bohai Sea, both naturally sourced and uranium spiked. They complemented this setup with a graphite anode and ran a cyclic current between the two electrodes.

Over time, the cloth began accumulating bright yellow precipitates composed of uranium, a testament to the effectiveness of their innovative material.

Incredibly, the results exceeded expectations. Over the course of 24 days, the electrodes managed to extract a remarkable 12.6 milligrams of uranium per gram of water. Notably, this capacity surpassed that of most other materials previously tested for uranium extraction. Moreover, the electrochemical approach proved to be approximately three times faster than natural ion accumulation on the cloth.

This remarkable achievement opens the door to a new era in sustainable nuclear energy production.

Seawater, which covers over seventy percent of the Earth’s surface, has now emerged as a viable and virtually limitless source of nuclear fuel. As the researchers aptly point out, their work offers an efficient and promising method for capturing uranium from seawater, ultimately transforming our oceans into a valuable supplier of nuclear fuel for the future.

With this breakthrough, the potential for a sustainable and abundant source of nuclear energy is within our grasp, ensuring a cleaner and more secure energy future for generations to come. And timing couldn’t be better, and more valuable on a global level, as uranium demand is hitting new highs and supply isn’t what it once was.

Uranium Market Soars to 16-Year Highs as Mine Struggle to Meet Demand

The uranium market is heating up, and miners are facing significant challenges in meeting the surging demand for this vital nuclear fuel source. This increasing demand has led to a remarkable rally in uranium prices, reaching levels not seen in nearly 16 years.

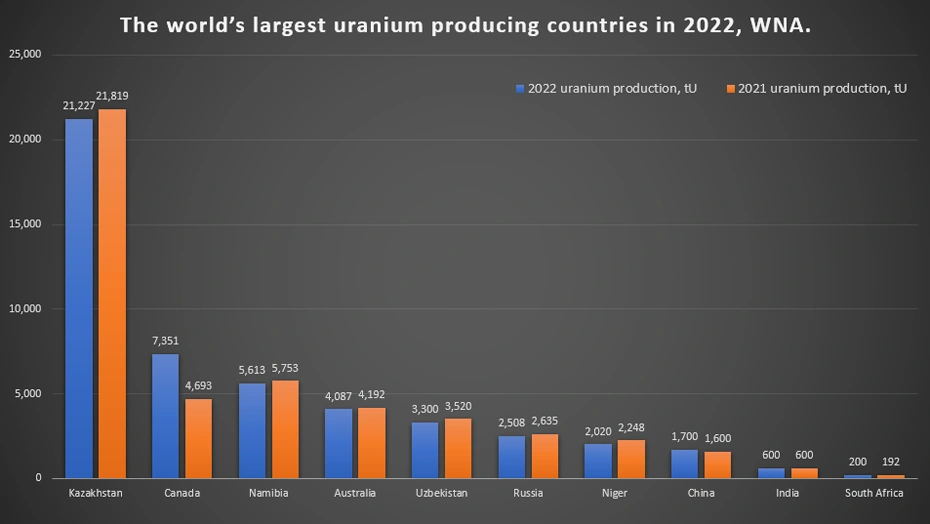

Cameco, one of the world’s largest uranium producers, is grappling with setbacks at key mines and has hinted at the possibility of needing to purchase more uranium to fulfill customer obligations by the end of the year. These setbacks include a drop in production in Niger following a military coup in July and a decline in production in Kazakhstan.

The result of these setbacks is intense competition among buyers for available uranium, driving prices to new heights. The price of U3O8, a processed uranium concentrate commonly known as yellowcake, has surged to $82.30 per pound, its highest level since the beginning of 2008, surpassing the peak reached in 2011.

The majority of uranium extracted by miners is sold under long-term contracts, often to U.S. power companies. When miners face supply shortfalls, it can lead to a reduction in uranium available for spot market deals, consequently driving up prices. As Jonathan Hinze, president of UxC, a uranium market-data firm, notes, “Spot supplies appear to be extremely sparse these days.”

Morgan Stanley analysts express bullish sentiment regarding uranium prices, predicting they will reach $95 per pound by the second quarter of 2024. This optimism is largely due to the persistent supply-demand imbalance in the uranium market.

Cameco’s challenges have played a significant role in the recent price surge. The Canadian company lowered its production forecast for the year, citing equipment reliability issues and a shortage of skilled labor. To address the supply gap, Cameco has signaled its intention to purchase up to 8 million pounds of uranium in the final quarter of the year, a significant increase compared to its 5 million pounds in purchases during the first nine months of 2023.

Production setbacks extend beyond Cameco’s operations.

Kazatomprom, Kazakhstan’s state uranium company, faces challenges due to shortages of critical materials like sulfuric acid, limiting its yellowcake production.

In Niger, French nuclear-fuel company Orano has encountered logistical challenges, leading to maintenance work and temporary shutdowns at its Somair plant and mine.

These setbacks have spurred heightened competition for uranium, attracting both financial buyers and utilities looking to bolster their uranium stockpiles amid concerns about potential disruptions. Entities like the Sprott Physical Uranium Trust and Uranium Royalty have reentered the market to acquire substantial quantities of U3O8, reflecting the rapid price escalation.

The rapid price rise has caught many companies off guard, making it difficult for them to adjust production plans promptly. Miners are cautiously observing whether elevated prices will be sustained before committing to reopening dormant mines or expediting new projects.

As Grant Isaac, Cameco’s chief financial officer, explains, “We’ve seen these markets before, and it always makes sense to let demand strengthen ahead of us making supply decisions.”

Despite these challenges, the nuclear energy sector is poised for growth. More than 20 countries, including the U.S., have pledged to triple nuclear energy capacity by 2050, recognizing nuclear power’s role in achieving global net-zero emissions.

Worldwide, approximately 60 nuclear reactors are under construction, with another 110 in the planning stages. Some existing plants have had their lifetimes extended, and Japan is gradually reopening power stations that were closed following the Fukushima disaster in 2011.

More To Discover

- 8 Alarming Trends in Corporate Control of Our Food Supply

- Iceland Unveils World’s Largest ‘Climate Vacuum’ to Tackle Atmospheric Carbon

- Consumer Reports Uncovers Widespread Harmful Chemicals in Supermarket Foods, Including Top ‘Healthy’ Brands

- Easy Food Swaps Could Slash Household Grocery Emissions by 26%

This surge in demand for nuclear energy is expected to stimulate new uranium mining projects in the near future. As Jonathan Hinze of UxC suggests, “I think we will see some serious movement on new uranium mine projects in the coming 12 to 24 months, assuming that current price increases hold and solidify further.”

The enthusiasm for uranium mining is already evident, with smaller uranium companies reviving operations in the U.S., Australia, and Namibia, capitalizing on the lucrative market conditions. Tim Gitzel, Cameco’s chief executive, notes the exceptional nature of the current cycle, saying, “We’ve never been this early in the cycle with prices as high as they are today.” As the global focus on nuclear energy intensifies, the uranium market is set to play a pivotal role in meeting the world’s growing energy needs.