When it comes to taking care of our furry companions, their health and well-being are top priorities. We spoil them with toys, treats (which has contributed to increasing rates of obesity in both cats and dogs), and endless belly rubs, but what about their medical needs? That’s where pet insurance comes into the picture.

In this article, we’ll dive into the world of pet insurance, exploring the good, the bad, and everything in between. We’ll break down average costs, examine the effectiveness of pet insurance, shed light on notable lawsuits, and introduce you to the key players in the industry.

So, let’s fetch some valuable insights and ensure your pet’s health is covered!

The Good: Benefits and Advantages of Pet Insurance

Financial Protection: Pet insurance can provide peace of mind by offering financial coverage for unexpected veterinary bills. It helps alleviate the stress of large medical expenses, allowing you to focus on your pet’s well-being rather than worrying about the cost.

Comprehensive Coverage: Most pet insurance plans cover a wide range of treatments and services, including accidents, illnesses, surgeries, and medications. Some plans even offer coverage for preventive care, such as vaccinations and annual check-ups.

Choice of Veterinarian: Unlike human health insurance, pet insurance typically allows you to visit any licensed veterinarian, giving you the freedom to choose the best care for your furry friend.

Tailored Plans: Pet insurance providers often offer various plan options to suit different budgets and coverage needs. You can select a plan that aligns with your preferences, whether it’s basic coverage or a more comprehensive package.

The Bad: Considerations and Limitations of Pet Insurance

Premiums and Deductibles

Like any insurance, pet insurance comes with costs.

Premiums can vary depending on factors such as your pet’s breed, age, location, and the level of coverage you choose.

Additionally, deductibles and co-pays may apply, which means you’ll still have some out-of-pocket expenses.

Pre-Existing Conditions

Most pet insurance plans do not cover pre-existing conditions. If your pet has a known medical issue before enrolling in insurance, it will likely be excluded from coverage.

It’s crucial to carefully review the policy’s terms and conditions to understand what is and isn’t covered.

Waiting Periods

Many pet insurance policies have waiting periods before certain conditions or treatments are covered.

This means that if your pet develops an illness shortly after enrolling, there may be a waiting period before you can make a claim.

Notable Lawsuits and Controversies

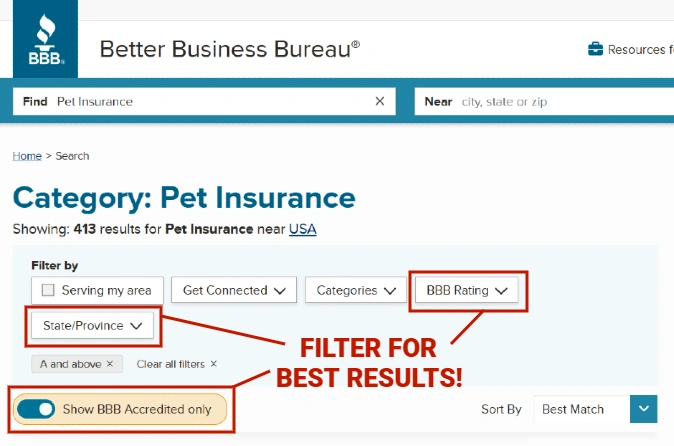

While pet insurance can be a valuable resource, it’s essential to be aware of notable lawsuits and controversies in the industry. For example, there have been cases where pet owners claimed their insurance providers denied coverage for legitimate claims or engaged in misleading advertising.

These incidents highlight the importance of thoroughly researching different insurance providers, reading customer reviews, and understanding the terms of the policy before making a decision.

Key Players in the Pet Insurance Industry

Several prominent companies dominate the pet insurance landscape, each offering unique plans and coverage options. Here are some of the key players in the industry:

- Nationwide Pet Insurance: Known for its comprehensive coverage, Nationwide offers a range of plans, including options for preventive care and wellness coverage.

- ASPCA Pet Health Insurance: With a focus on providing flexible coverage, ASPCA offers plans tailored to different budgets and needs, including accident-only coverage and full illness and injury coverage.

- Trupanion: Trupanion provides a lifetime coverage option, which can be particularly appealing for pets with chronic conditions or recurring illnesses.

- Embrace Pet Insurance: Embrace stands out with its personalized policies that allow you to customize your coverage, including optional coverage for alternative therapies.

A Vet's Perspective: Most Expensive & Cheapest PET Insurance

What Do The Most Popular Procedures in the US Cost Nationwide?

Keep in mind that these are approximate figures and can vary based on factors such as location, the severity of the condition, and the veterinarian’s fees.

- Dogs: $200-$500

- Cats: $100-$300

- Dogs: $300-$700

- Cats: $200-$500

X-rays:

- $100-$300 per image, depending on the size and complexity

Blood Tests:

- Basic blood panel: $50-$150

- Comprehensive blood panel: $150-$300

- Core vaccinations: $50-$100 per year

- Non-core vaccinations: $20-$50 each

Mass/Tumor Removal:

- Small mass: $200-$500

- Large mass: $500-$1,000+

Fracture Repair:

- Simple fracture: $500-$1,000

- Complex fracture: $1,000-$3,000+

Foreign Body Removal:

- $500-$2,000, depending on the location and complexity

Allergy Testing:

- $200-$500, excluding treatment costs

Ear Infection Treatment:

- $100-$300, depending on the severity and duration

Of course, these costs are estimates, and prices can vary significantly depending on factors such as geographical location, the size of the pet, the specific condition being treated, and the veterinarian’s fees. Always keep in mind that emergency procedures or specialized treatments may incur higher costs.

Pet insurance can be a valuable tool in safeguarding your furry friend’s health and providing financial peace of mind.

The benefits of comprehensive coverage and the ability to choose your preferred veterinarian are definite advantages.

More To Discover

However, it’s important to consider the costs, limitations, and potential exclusions of pet insurance. Research different providers, compare plans, and carefully read policy details to make an informed decision that aligns with your pet’s needs and your budget.

Remember, the goal is to ensure your pet receives the care they deserve while protecting yourself from unexpected financial burdens. Happy tails and healthy adventures await with the right pet insurance by your side!