JBS Global Operations Carbon Emissions Exceed Ireland’s

As the environmental spotlight intensifies on the global meat industry, JBS, headquartered in São Paulo, Brazil, and a dominant force in the market since 1953, faces legal scrutiny in New York. Despite generating nearly $4 billion in net income on $65 billion in revenue and operating across about 180 countries, JBS’s ambitious claim of reaching net-zero emissions by 2040 has been met with skepticism and a lawsuit from New York Attorney General Letitia James.

Dakoa previously wrote about this lawsuit when the New York Attorney General’s office first filed against the beef giant, but now we’re going to dig a little deeper and explain why this lawsuit is important.

Responding to the controversy, JBS expressed its disagreement with the lawsuit’s premises. In a statement to the Wall Street Journal, the company emphasized its commitment: “will continue to partner with farmers, ranchers, and our food system partners around the world to help feed a growing population while using fewer resources and reducing agriculture’s environmental impact.”

Despite these assertions, the environmental challenges associated with meat production, especially beef, loom large. Livestock farming is notorious for its emissions, contributing to 57 percent of the food system’s emissions and driving deforestation, particularly in Brazil’s Amazon rainforest.

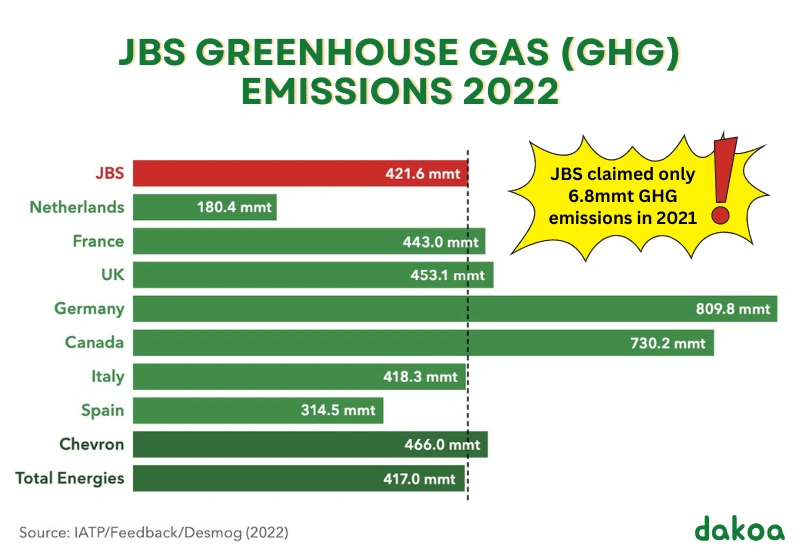

The lawsuit highlights a stark reality: JBS’s reported emissions surpass those of entire countries, like Ireland, with external audits indicating a significant increase in emissions over recent years. Such figures call into question the feasibility of JBS’s net-zero ambitions, especially considering the meat industry’s role as a stumbling block in meeting global climate targets.

Central to the lawsuit’s allegations is the claim that JBS’s net-zero promise lacks a solid foundation. To put it simply, they’re senseless!

The company’s emissions reporting, crucial for understanding its environmental impact, is incomplete, particularly regarding scope 3 emissions that encompass most of its carbon footprint.

“The company doesn’t have a reliable baseline emissions number from which it could plan to achieve net zero,” the lawsuit contends, emphasizing the absence of a clear plan for reaching the net-zero goal.

At a New York Times event, JBS CEO Gilberto Tomazoni’s strategy focused on “regenerate agriculture” as a key to reducing emissions.

However, the lawsuit and critics argue that the term ‘regenerative’ lacks a clear definition, casting doubt on its effectiveness in offsetting the significant emissions from beef production.

In fact, JBS has repeatedly failed to communicate even what the world’s largest beef producer considers to be ‘regenerative agriculture’. Instead, company spokespeople merely repeat one of the most overused buzz phrases in greenwashing.

The case against JBS not only challenges the company’s environmental claims but also raises broader questions about the sincerity and feasibility of corporate commitments to combating climate change, highlighting the need for transparency and verifiable actions in the journey towards sustainability.

As If Greenwashing Wasn’t Bad Enough, Now There’s Humanewashing

This lawsuit casts a light on the troubling practice of agricultural greenwashing, not merely as corporate embellishment, but as a pivotal issue where legal measures can confront food corporations’ misleading environmental claims. This case is part of a broader movement to safeguard consumers from being misled by companies that exploit their environmental and ethical concerns for profit, similar to movements throughout Australia and the UK.

Greenwashing, the act of making unfounded or misleading claims about the environmental benefits of a product or service, is a well-documented issue across various industries, including plastics and fossil fuels. Recognizing this, the Federal Trade Commission (FTC) has developed “Green Guides.”

Although these guides are advisory and not legally enforceable, they’ve formed the foundation for numerous class-action lawsuits by delineating how companies should navigate consumer protection laws when making environmental claims. Despite their focus on recyclability and similar issues, the environmental law firm Earthjustice has pushed for these guidelines to encompass agriculture sustainability claims, pointing directly at JBS’s net-zero emissions promise as a prime example of misleading marketing.

Moreover, the meat industry faces accusations of “humanewashing” – the practice of falsely advertising products as originating from well-treated, freely roaming animals, when in reality, they come from industrial-scale factory farms. This tactic preys on consumer empathy and ethical concerns, much like the shift towards “climate-friendly” messaging aims to capitalize on growing awareness of the environmental impact of meat production.

The regulatory landscape for agribusiness has traditionally been permissive, perhaps encouraging such deceptive marketing practices.

For example, the USDA approved a “climate-friendly” beef product by Tyson Foods, which claimed to produce 10 percent less emissions than conventional beef without providing a clear baseline (or any evidence at all) for this reduction, making the claim effectively meaningless.

Amanda Howell, managing attorney for the Animal Legal Defense Fund, emphasizes the importance of this case, stating it alerts the livestock industry to the fact that “government officials are paying attention to the next and most concerning advertising trend on part of animal agribusiness.”

Through litigation against companies like Hormel and Trader Joe’s for humanewashing claims, there’s a burgeoning effort to enforce accountability, highlighting a crucial turn in the fight against greenwashing practices that threaten consumer trust and environmental integrity.

Can Legal Actions Clean Up Big Meat?

What this lawsuit comes down to is simple – corporate environmental accountability.

New York’s Attorney General, Letitia James, believes JBS’s grandiose claims of achieving “net zero” emissions are genuinely misleading reasonable consumers. This challenge is steeped in the broader debate over greenwashing and humanewashing, where companies often defend their marketing as mere “puffery” or acceptable exaggeration.

JBS faces a formidable hurdle in proving the validity of its explicit net-zero assertions. The skepticism around these claims was echoed in March 2023 by the BBB National Programs’ National Advertising Division (NAD), which advised JBS to halt its unverifiable net-zero advertising, a recommendation stemming from a complaint by the Institute for Agriculture and Trade Policy. Despite the non-binding nature of the NAD’s decision, JBS opted to disregard the directive.

This legal confrontation is set against a backdrop of JBS’s troubled history with allegations of fraud and corruption. The company and its affiliates have encountered a series of legal penalties, including a colossal $3.2 billion fine in 2017 for a bribery scandal in Brazil, a $128 million fine in 2020 for bribery charges in the US, and a $110 million fine the same year for price-fixing in the chicken market.

These controversies, coupled with a lawsuit over the issuance of over $3 billion in “green” bonds tied to dubious sustainability goals, paint a picture of a corporation repeatedly mired in misconduct.

The concerns over JBS’s ethical and environmental practices have even reached the US Senate, with Sen. Cory Booker and a bipartisan coalition urging the Securities Exchange Commission to block JBS from listing stock on the New York Stock Exchange, highlighting the company’s “extensive international corruption record” and environmental ramifications.

We’re at a critical juncture for the entire meat industry. In an era where regulatory bodies like the USDA appear hesitant to impose stringent environmental standards, legal challenges like this one are becoming the only tool available to enforce accountability.

This case not only aims to check the veracity of climate pledges from major meat producers but also seeks to educate and alert both the public and policymakers.

More To Discover

- Antarctica’s Ice Melt Matters: A Disappearing Act with Global Consequences

- The World’s Cleanest Electric Snowmobile: A Pininfarina Collaboration

- Yellowstone Faces ‘Zombie Deer Disease’ Threat, Scientists Warn of Human Risk

- LanzaJet’s Sustainable Plant In Georgia Will Produce 10 Million Gallons of Eco-Friendly Jet Fuel to Tackle Airline Emissions

Peter Lehner of Earthjustice emphasizes the broader implications, hoping the case will enlighten policymakers about the true environmental cost of industrial agriculture, often obscured by exemptions and a lack of awareness. By casting a spotlight on these issues, the lawsuit against JBS may catalyze a more informed debate on the sustainability of animal agriculture, challenging both industry and legislative leaders to acknowledge and address its significant environmental impacts.

JBS's Troubled Legal Track Record

JBS has a history of violations. As such, the company has faced numerous legal challenges and penalties, which naturally does make their environmental commitments less believable:

- Price-Fixing Penalties: Settled with the U.S. Department of Justice for $53 million over beef market price-fixing (Feb 2022), and agreed to $76 million and $12.7 million settlements for poultry and pork price-fixing, respectively (Dec 2021 & Nov 2021).

- Safety and Regulatory Violations: Incurred a $59,000 fine from the U.S. Occupational Safety and Health Administration following a fatality at one of its operations (Oct 2021), alongside multiple fines for failing to protect employees during the COVID-19 pandemic (2020).

- Corruption and Bribery: Settled with the U.S. Securities Exchange Commission for $27 million over violations of the Foreign Corrupt Practices Act (2020), and paid a staggering $3.2 billion for bribing Brazilian finance officials (2017).

- Executive Legal Issues: Witnessed the indictment of six executives from its poultry division, Pilgrim’s Pride, on federal price-fixing charges (2020).