In the world of sustainable investing, a new chapter is unfolding, marked by emerging practices like ‘greenhushing’ and ‘green-bleaching.’ These terms join ‘greenwashing’ in the lexicon of deceptive practices surrounding environmental, social, and governance (ESG) factors in investment funds. Now, the argument can be made, which we do, that these are just extra little offshoots of classic greenwashing.

As we know, greenwashing comes in many forms usually associated with marketing practices and publicity like in the fast fashion industry or so-called eco-friendly products, but, in this article we’re going to focus on the investment side. After all, no industry exists with or without greenwashing if no one is channeling money to it.

A recent report by the global securities watchdog, IOSCO (International Organization of Securities Commissions), sheds light on these evolving challenges.

For years, greenwashing has been a thorn in the side of ESG investing. It refers to the practice of funds exaggerating their sustainability credentials, misleading investors who seek environmentally conscious investments. Despite its prevalence, regulators grapple with a significant hurdle: the absence of a binding legal definition for greenwashing. This lack of clarity blurs the lines for legal enforcement and allows malpractices to flourish.

However, greenwashing is no longer the sole concern. IOSCO’s report, coinciding with the COP28 U.N. climate summit in Dubai, highlights the emergence of ‘greenhushing’ and ‘green-bleaching.’

Greenhushing occurs when companies under-report their sustainability achievements to dodge investor scrutiny, while green-bleaching involves asset managers downplaying the sustainability aspects of their funds to evade regulatory burdens.

Demystifying the Jargon: Greenwashing, Greenhushing, and Green-bleaching Explained

In the convoluted world of ESG (Environmental, Social, and Governance) investing, three terms often cause confusion: greenwashing, green-hushing, and green-bleaching. To understand them better, let’s use simple analogies.

Think of greenwashing as the deceptive makeup of sustainability. It’s like a corporation wearing a ‘green’ mask to look environmentally friendly, much like a car manufacturer bragging about their one electric vehicle model while primarily producing gas-guzzlers. It’s the illusion of eco-friendliness without the substance.

Greenhushing, on the other hand, is akin to the silent environmentalist. Imagine a company that’s doing great things for the planet – like using renewable energy or reducing waste – but they’re keeping it a secret. It’s like having a beautiful garden but hiding it behind a wall, missing the chance to inspire others.

Lastly, green-bleaching is the art of playing down one’s green efforts, often for regulatory evasion. Picture a fund manager downplaying the sustainable aspects of their investments to sidestep stricter ESG compliance. It’s like owning an energy-efficient house but not talking about it to avoid higher taxes or scrutiny.

The Regulatory Problem

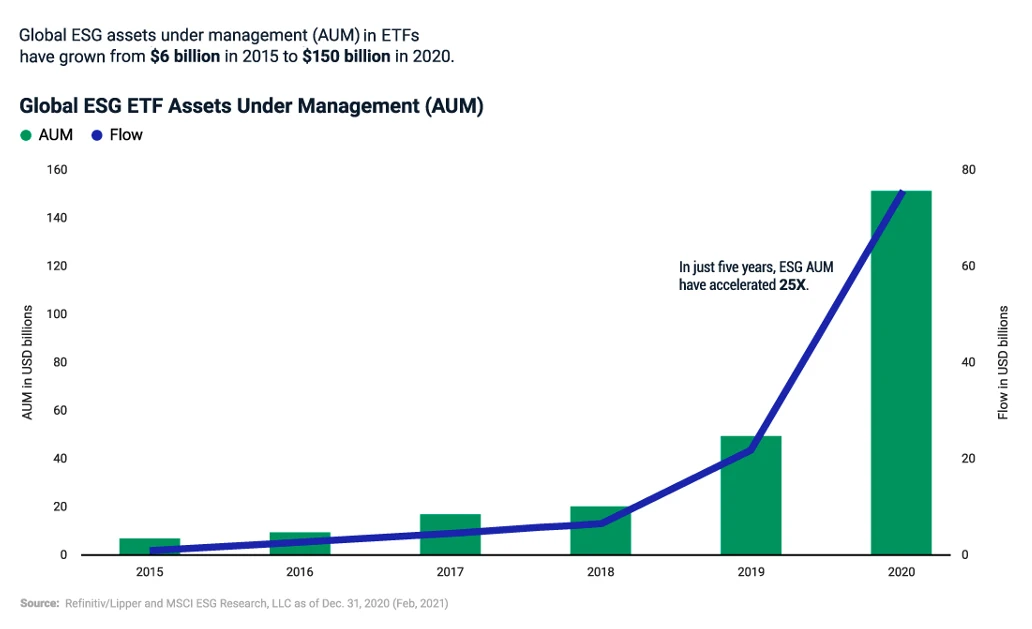

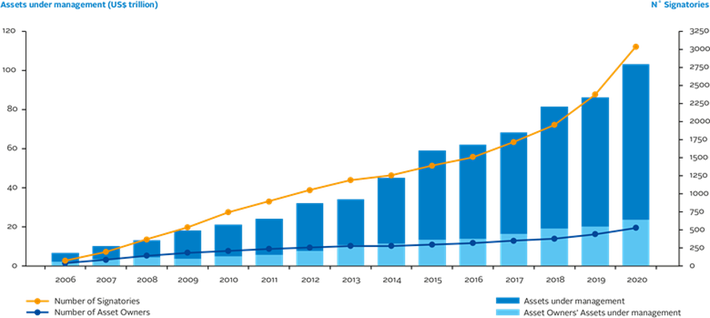

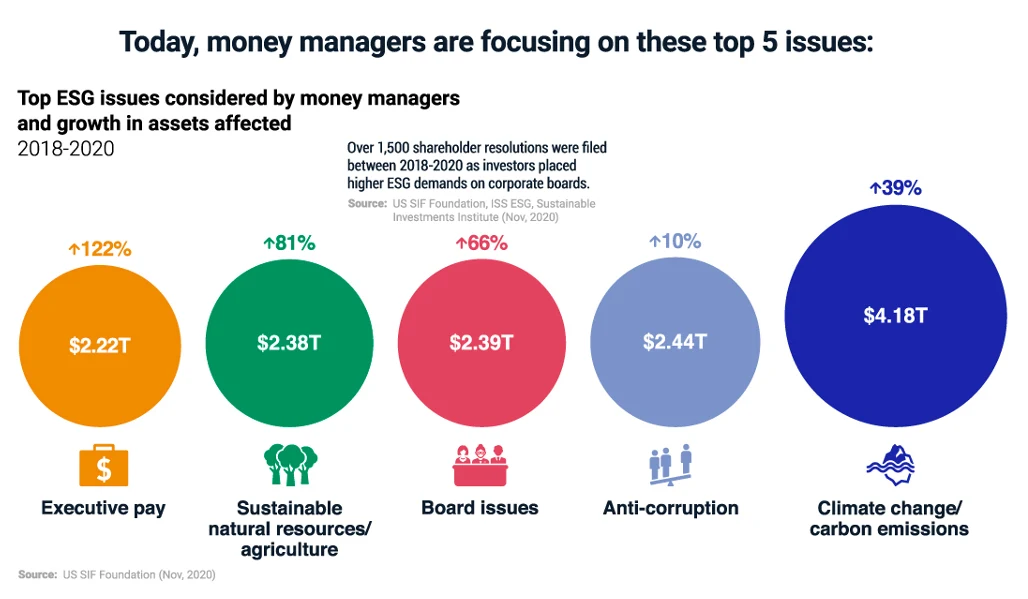

The influx of trillions of dollars into investment funds that proudly tout their environmental, social, and governance (ESG) factors has made the issue of greenwashing increasingly significant, and very frustrating. IOSCO’s report, released to coincide with the COP28 U.N. climate summit in Dubai, has revealed the extent of the greenwashing problem “malpractices” within the industry.

These practices represent a complex challenge for regulators.

Data gaps, concerns over the quality of ESG benchmarks, and inconsistent fund labeling threaten investor protection and market integrity. IOSCO emphasizes the need for more robust supervisory practices and enforcement regimes to tackle these issues effectively. However, the task is daunting as these malpractices can vary in form, scope, and severity.

Around the globe, some regulators have begun imposing fines for greenwashing.

For instance, in Europe, several high-profile asset managers have faced penalties for overstating the green credentials of their funds. Similarly, in the United States, the Securities and Exchange Commission (SEC) has ramped up its scrutiny of ESG claims by investment funds.

To counter these risks, IOSCO points to upcoming climate-related corporate disclosures in the European Union and globally, along with new regulations for ESG ratings, as steps in the right direction. These measures aim to provide more transparency and standardization in ESG reporting, making it harder for firms to engage in deceptive practices.

More To Discover

- Transparency Gap: Companies Fail to Report Impact of Environmental Initiatives

- Grain Husk Packaging: The Future Alternative to Plastic Styrofoam in Your Next Delivery

- They’re Transforming Discarded Bones Into Sustainable Food: Would You Eat It?

- Carnegie Mellon Study Proves Grocery Delivery Is Less Sustainable than In-Store Shopping

As the ESG investing landscape evolves, so do the tactics used to exploit it. Greenwashing, greenhushing, and green-bleaching represent a triad of challenges that regulators and investors must vigilantly combat.

The journey to a more transparent and honest ESG investment space is complex, but with concerted global efforts, progress can be made in safeguarding the integrity of sustainable investing.