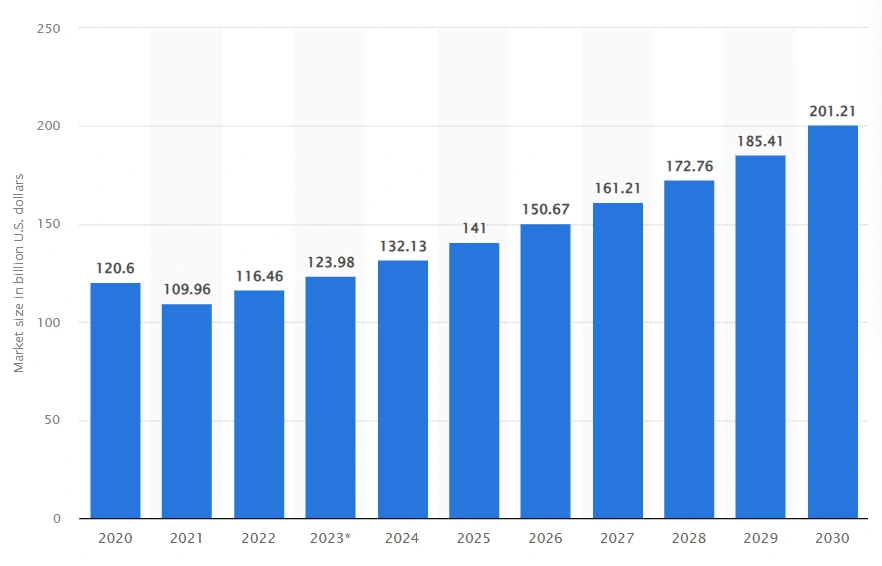

The global race to lead in biofuel production is intensifying, with nations and corporations around the world ramping up efforts. Biofuels are gaining traction as a sustainable alternative for transportation, shipping, and aviation.

Recent investments are set to expand production capacities in countries like Canada, the U.S., and the EU, potentially leading to lower prices through mass production and technological advancements. These regions are vying to become biofuel giants, backed by supportive policies and funding initiatives.

Alberta’s government recently greenlit a $1.2-billion biofuel project in Calgary, aiming to open by 2026. This project, known as Future Energy Park, will significantly boost Canada’s renewable natural gas (RNG) supply, tripling the current output. It’s designed to transform non-food grade waste into RNG, alongside producing ethanol and cattle feed that reduces methane emissions. This initiative, spearheaded by Green Impact Partners and supported by Alberta’s Ministry of Environment and Protected Areas, is a major economic booster. “It’s ready to get built and certainly has a massive impact on the local economy and the local supply chain,” said Jesse Douglas, CEO of Green Impact Partners.

Spanning nearly 52 acres (21 hectares), Future Energy Park is expected to create 800 construction jobs over two years and 100 permanent operational jobs. The economic benefits are substantial, with potential annual revenues of $50 million for the city and $150 million for wheat producers. The facility stands out for its low emissions, utilizing carbon capture and storage technology to process any released methane and carbon dioxide into natural gas or fuel. This positions it as “North America’s largest carbon-negative biofuels facility”.

Even with this progress, Canada’s overall gas production, is still heavily reliant on fossil fuels, and will see less than a one percent contribution from this facility.

The high costs of constructing and operating biofuel plants remain a challenge.

While natural gas production costs range between $2.20 to $3 per MMBtu, renewable natural gas stands at about $22 per MMBtu, making it far less practical. However, the hope is that increased investment and technological innovations in mass biofuel production will eventually reduce costs.

In the United States, the Biden administration, as part of its Investing in America Agenda, has launched a significant biofuel funding program. Using $500 million from the Inflation Reduction Act, the USDA aims to bolster domestic biofuel capacity.

Secretary Tom Vilsack remarked, “President Biden’s Inflation Reduction Act is a historic investment that will expand clean energy, lower costs for Americans, and build an economy that benefits working families and small businesses.” He also highlighted the role of biofuels in enhancing energy independence, creating market opportunities for American producers, and generating economic benefits for rural communities. This follows a $50 million investment from the IRA in 2022 for 59 infrastructure projects under the Higher Blends Infrastructure Incentive Program.

The U.S. is also witnessing private sector growth in biofuels, driven by supportive climate policies. For instance, SGP BioEnergy, based in New York, secured $250 million from Global Emerging Markets for the Golden City Biorefinery in Panama. Once operational, this plant is set to produce up to 180,000 barrels per day of renewable fuel and around 405,000 metric tons of green hydrogen annually, potentially becoming one of the largest of its kind globally.

Europe’s biofuel industry is expanding but faces criticism over the EU’s approach.

Despite the Renewable Energy Directive’s support for biofuels like renewable ethanol, other EU policies seem to underplay the strategic importance of these fuels.

Critics, including David Carpintero of ePURE, call for a mindset shift within the EU to foster investment in large-scale commercial biofuel facilities. “Europe needs more than just one solution to achieve real transport de-fossilization,” Carpintero asserts.

More To Discover

- Enviva’s Wood Pellet Plant in Georgia, the World’s Largest, Is Exceeding Pollution Limits According To State

- Fusion Energy: The Key to Completing the World’s Net Zero Mission, Says Industry Leader

- 8 Unexpected Ways to Decarbonize the Shipping Industry Immediately

- Trillion Dollar Lies: What Happened in 2018 That Transformed Renewable Energy Forever

A recent Commission report indicates that bioenergy, derived from agricultural, forestry, and organic waste, constituted about 59 percent of Europe’s renewable energy consumption in 2021.

Most EU member states are promoting biogas and biomethane, aligning with the Commission’s REPowerEU plan. This plan seeks to boost the production of sustainably produced biomethane, aiming to reduce Europe’s dependence on fossil fuels.