The Biden administration has taken a bold step to introduce transparency and foster competition in the meat industry, particularly targeting the practices of large meatpackers. A groundbreaking federal rule, enacted last Wednesday, mandates that big meatpackers must clearly inform chicken growers about the potential risks involved in their contractual agreements.

USDA Secretary Tom Vilsack emphasized that this rule is a crucial part of a broader reform package aiming to revitalize fairness and competition in the meat industry. This package includes directives for the government to prioritize purchasing U.S.-produced meat and the establishment of a new office dedicated to combating agricultural monopolies.

A significant aspect of the reform is the requirement for seed companies to display generic varietal names alongside brand names, mirroring the labeling practices seen in pharmaceuticals like acetaminophen and its brand equivalent, Tylenol. This move aims to enhance consumer understanding and choice.

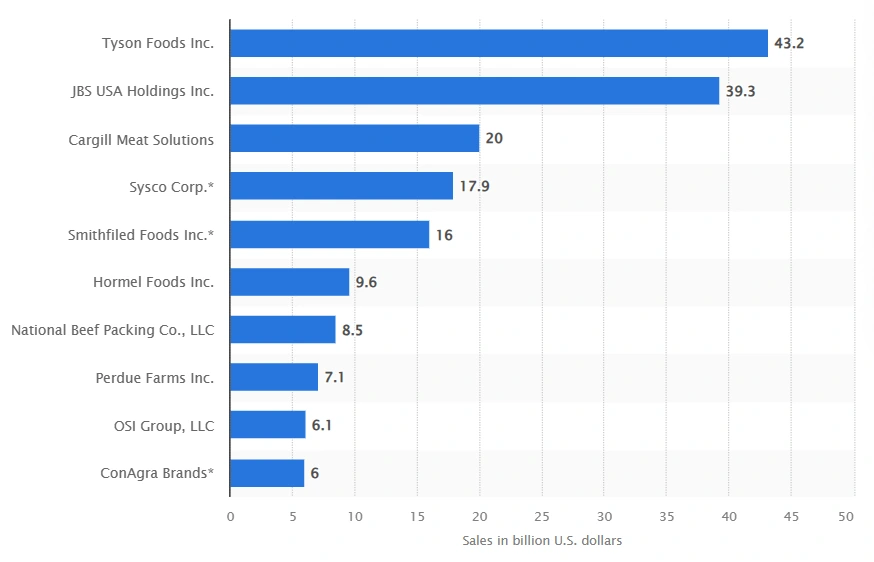

For decades, independent farmers have voiced their concerns over the negative impacts of the meat industry’s rapid consolidation, a trend that began with government-backed mergers in the 1990s. This consolidation, primarily led by major players like Tyson and Pilgrims, has been associated with allegations of corruption, market manipulation, and retaliatory practices against dissenting farmers.

The new USDA rule specifically targets these contentious practices in the chicken sector, seen as a prime example of anticompetitive farming practices.

Chicken farmers have long complained about deceptive practices by large meatpackers, particularly regarding the financial returns from contracts and the punitive measures taken when these terms are challenged.

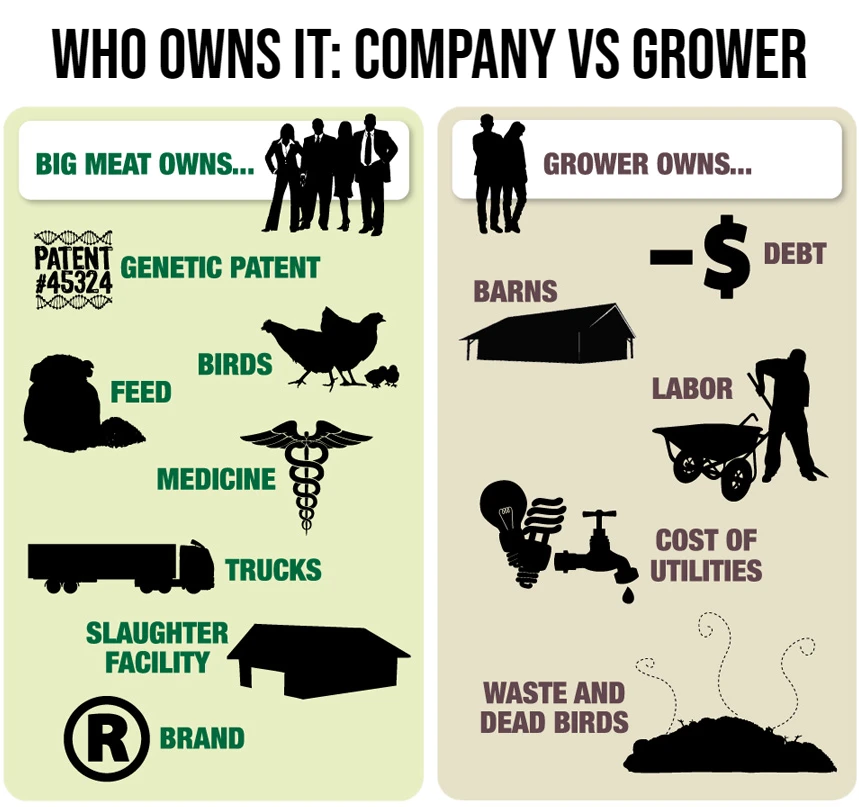

The USDA’s rule addresses the opaque nature of these contracts, which often leave farmers in precarious financial situations. Farmers, compelled to invest heavily in advanced facilities to secure contracts, find themselves trapped in unfavorable deals, highlighting a significant disparity between expected and actual earnings.

This imbalance of power, often likened to feudal serfdom, is precisely what the USDA aims to rectify. The rule points out the manipulative tactics employed by meatpackers, such as presenting overly optimistic financial prospects to entice farmers into costly investments.

However, the rule has faced criticism from the National Chicken Council (NCC), with President Mike Brown accusing it of fostering unnecessary litigation and potentially dismantling a successful industry structure. The NCC also raised concerns over the challenging timeline set for amending thousands of contracts.

On the other hand, farmers’ groups have welcomed the rule, though some argue that it doesn’t go far enough. Rob Larew, president of the National Farmers Union, lauded the rule for demanding greater honesty from poultry companies.

Environmental groups, however, criticized the USDA for limiting the rule to the broiler chicken industry, urging broader protections against corporate exploitation in other agricultural sectors.

The USDA’s efforts extend beyond chicken farming. Additional rules mandate federal buyers to source only domestically raised pork and beef, a move seen as a boon to American farmers. This shift addresses concerns from ranchers about the impact of imported meat on the U.S. market, as highlighted by Bill Bullard of R-CALF.

Sarah Little, representing the North American Meat Institute, warned that such segregation in meat sourcing could increase costs, burdening taxpayers, and public systems during challenging times.

Additionally, the USDA plans to appoint a chief competition officer to address monopolistic practices in the meat industry. Alongside, four proposed amendments to the Packers and Stockyards Act aim to empower farmers with greater legal recourse against discriminatory treatment.

As these reforms progress, Angela Huffman of Farm Action urges swift action. She warns that delays could lead to a repeat of past setbacks experienced under Secretary Vilsack’s tenure during the Obama administration, highlighting the urgency of implementing these changes before potential political shifts could jeopardize them.

More To Discover

- World’s Oceans Hit New Temperature High, Sparking Climate Concerns

- Nestle, Kellogg’s and Colgate Palm Oil Supplier Deforested 50 Square Miles Of Peru’s Amazon Rainforest

- Key Challenges at COP28: From Carbon Market Integrity to Methane Emissions and even Innovative Financing

- Lasers Can Transform Poultry Farming for Better Chicken Health, Welfare, And Flavor

Due to the complexities of the law, and how laws are written in general, we’ve compiled a cheatsheet for you that breaks down each aspect of the new rules.

The New Federal Rule on Meat Industry Monopolies: Key Implications

- For Chicken Growers:

- Mandatory disclosure of risks in contracts with big meatpackers.

- Increased transparency in contract terms, helping growers understand potential financial returns and risks.

- Protection against deceptive practices and potential manipulative tactics by large meatpackers.

- For Meatpackers (e.g., Tyson, Pilgrims):

- Requirement to provide clearer and more honest communication with chicken growers.

- Potential legal and regulatory scrutiny for non-compliance with the new transparency standards.

- Challenges in adapting to new rules, including possible amendments to existing contracts.

- For Seed Companies:

- Obligation to display both generic varietal names and brand names, akin to pharmaceutical labeling practices.

- For the U.S. Government and USDA:

- Commitment to purchasing meat produced in the U.S., supporting domestic farmers.

- Establishment of a new office to combat monopolies in agriculture.

- Introduction of a chief competition officer to oversee and enforce fair practices in the meat industry.

- For the Broiler Chicken Industry:

- Specific focus as the initial target of the rule, addressing long-standing complaints from chicken farmers about unfair practices.

- A move towards more balanced and equitable industry practices.

- For Farmers’ Groups:

- A welcomed step towards greater fairness and transparency, although some groups advocate for more comprehensive measures.

- Expectation of more honest dealings from poultry companies.

- For Environmental and Consumer Advocacy Groups:

- Criticism for the rule’s limited scope, focusing only on the broiler chicken industry and not extending to eggs, milk, beef, and pork.

- Calls for broader protections against corporate exploitation in other sectors of agriculture.

- For the Meat Industry at Large:

- Anticipation of further reforms that might affect other sectors like pork and beef.

- Potential shifts in market dynamics due to new procurement policies favoring U.S.-raised livestock.

- For Consumers:

- Enhanced understanding of where and how their meat products are sourced.

- Potential for future changes in meat prices due to shifts in industry practices and government procurement policies.

- In Legal and Regulatory Contexts:

- The possibility of increased litigation because of the new transparency requirements, as predicted by industry groups like the National Chicken Council.

- Opening avenues for farmers to legally challenge unfair treatment and discriminatory practices.

- For Chicken Growers:

This rule marks a significant step in reshaping the dynamics of the meat industry, aiming to restore balance and fairness in a sector that has long been dominated by a few major players.