In the digital era, cryptocurrency has emerged as a groundbreaking innovation, with Bitcoin leading the charge as a new form of currency, untethered from the traditional banking system. Its decentralized nature promises a revolution in how we perceive and transact value. However, beneath the digital glitz lies an inconvenient truth: the environmental cost of cryptocurrency mining.

This article, drawing from recent comprehensive research, aims to shed light on the environmental implications of Bitcoin mining globally and exactly why the researchers are calling for urgent action.

The Staggering Energy Consumption of Bitcoin Mining

Bitcoin mining has become synonymous with massive energy consumption, a topic that has sparked both economic excitement and environmental concern. The process, which underpins the Bitcoin network, requires an ever-increasing amount of computational power to solve complex mathematical puzzles, a mechanism known as Proof-of-Work (PoW).

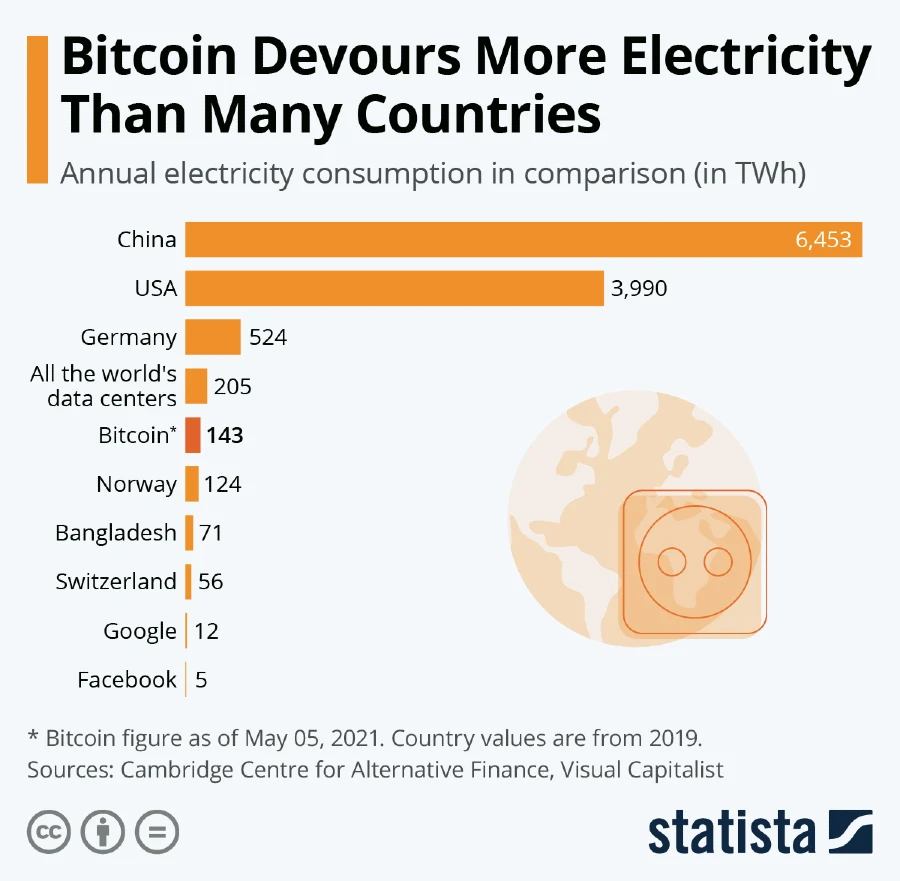

This has led to an arms race of sorts, where miners across the globe compete to process transactions and earn rewards in the form of new Bitcoin. The result is an electrical demand that exceeds the consumption of many individual countries.

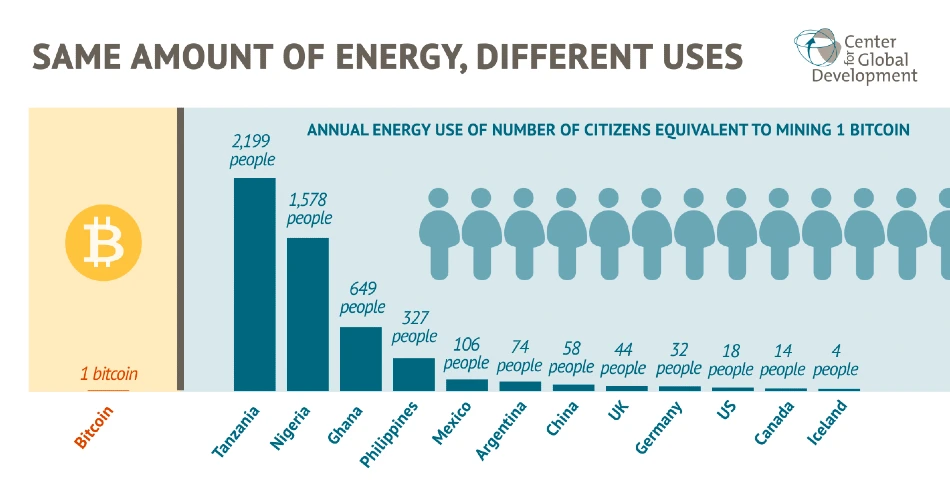

A recent study draws a stark picture: between 2020 and 2021, the worldwide Bitcoin mining network consumed an estimated 173.42 terawatt-hours (TWh) of electricity. To visualize this, it’s more than the electrical consumption of Argentina, a country with a population of over 45 million.

If Bitcoin were a country, its energy consumption would rank it 27th worldwide, surpassing that of Pakistan, a nation of over 230 million people. This comparison isn’t just to illustrate the magnitude, but also to underscore the gravity of the situation as it stands against the backdrop of global energy needs and climate goals.

Mining operations, while increasingly efficient in their energy use, have ballooned in number, with approximately 1 million active miners estimated globally. Each miner represents a node in the network, and collectively, they contribute to an immense power draw. The significant increase in Bitcoin’s total hashrate—a measure of the computational power per second used for mining—indicates that more resources are being allocated to the network, further inflating its energy requirements.

In the United States alone, the cumulative power required for annual Bitcoin mining could power over 10 million households.

The environmental implications of this energy use are profound.

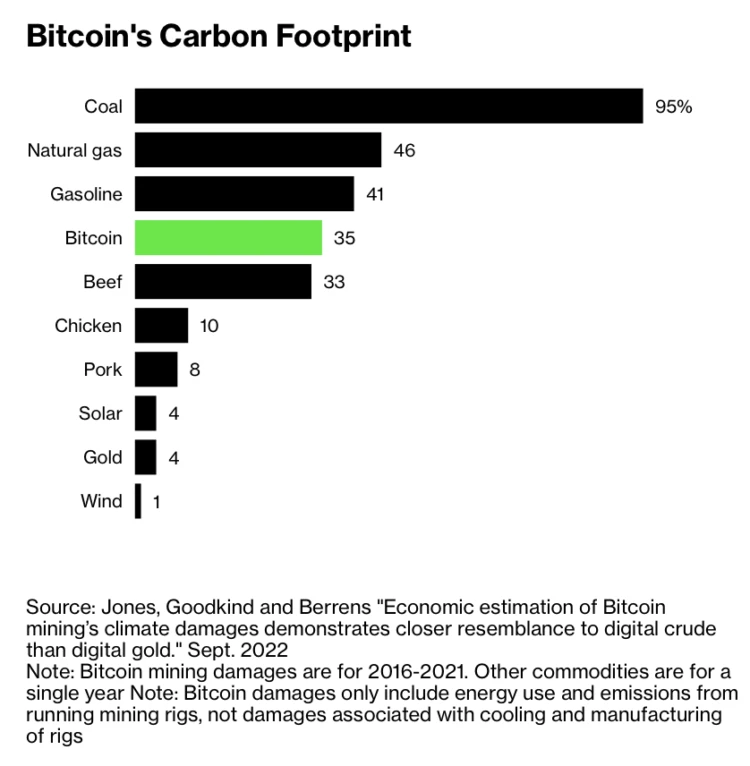

Most of Bitcoin’s energy mix still relies on fossil fuels, with coal accounting for a significant portion. This dependence has led to the emission of over 85.89 million metric tons (Mt) of carbon dioxide equivalent (CO2eq) during the same 2020-2021 period, a figure comparable to the carbon footprint of 84 billion pounds of burned coal or the annual operation of 190 natural gas power plants.

Such emissions have sparked debates about the sustainability of Bitcoin and other cryptocurrencies, especially as nations strive to meet the Paris Agreement targets and limit global warming.

The use of renewable energy sources within Bitcoin mining is often highlighted as a mitigating factor for its carbon footprint. Hydropower, for instance, satisfies a notable portion of the global Bitcoin network’s electricity demand. However, hydropower comes with its environmental trade-offs, particularly in terms of water use and land impact.

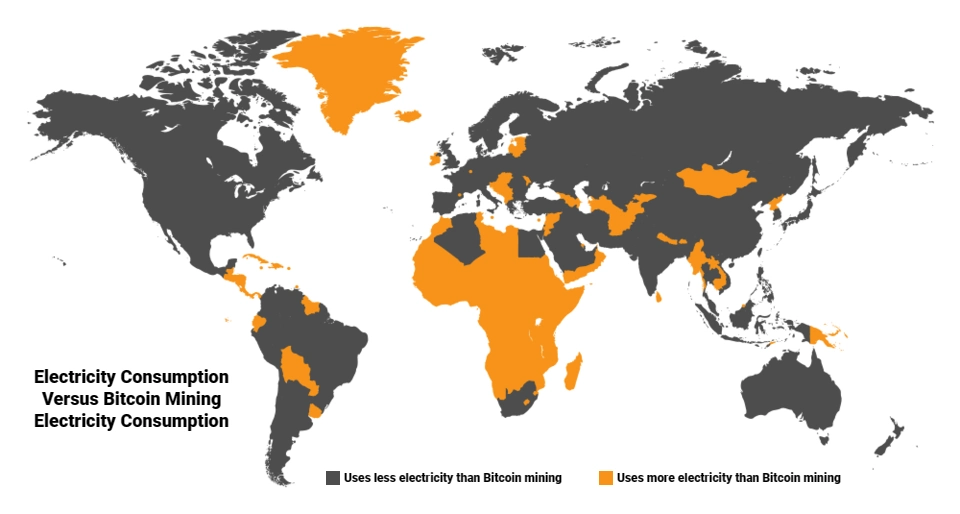

The energy source mix varies significantly by country, reflecting differing environmental footprints for Bitcoin mining operations worldwide. This geographical disparity illustrates that the environmental impact of Bitcoin isn’t uniform; it’s distributed unevenly across the globe, influenced by each region’s energy policies and availability of renewable resources.

Moreover, the price of Bitcoin itself has a direct impact on mining activity.

Higher prices can drive an increase in mining as more individuals and companies seek to capitalize on the profitability of Bitcoin. This leads to higher energy consumption and, consequently, a larger carbon footprint. The correlation between Bitcoin’s price and energy consumption has been observed to be as high as 77% over certain periods, demonstrating how market dynamics can have immediate environmental repercussions.

Considering this, the call for regulation and innovation is growing louder. The study emphasizes the urgent need for policy interventions, technological breakthroughs, and scientific research to mitigate the environmental costs associated with Bitcoin mining. Suggested measures include increased transparency, economic and regulatory tools, and the development of alternative coins and blockchain validation protocols that are less energy intensive.

The environmental cost of Bitcoin mining is a multifaceted challenge that intersects with issues of climate change, energy policy, and the future of digital currencies. As the world increasingly integrates cryptocurrency into the financial system, the demand for a balanced approach that accounts for both the economic benefits and environmental impacts of digital currencies becomes ever more pressing.

Crypto’s Carbon Footprint: A Climate Change Accelerant

The carbon footprint of Bitcoin mining has raised significant alarm bells around the world, marking it as a potential catalyst for climate change acceleration. The computational backbone of Bitcoin, the Proof-of-Work (PoW) system, requires a colossal amount of electrical power. The environmental ramifications of this energy consumption are vast, particularly when we consider the sources of this power.

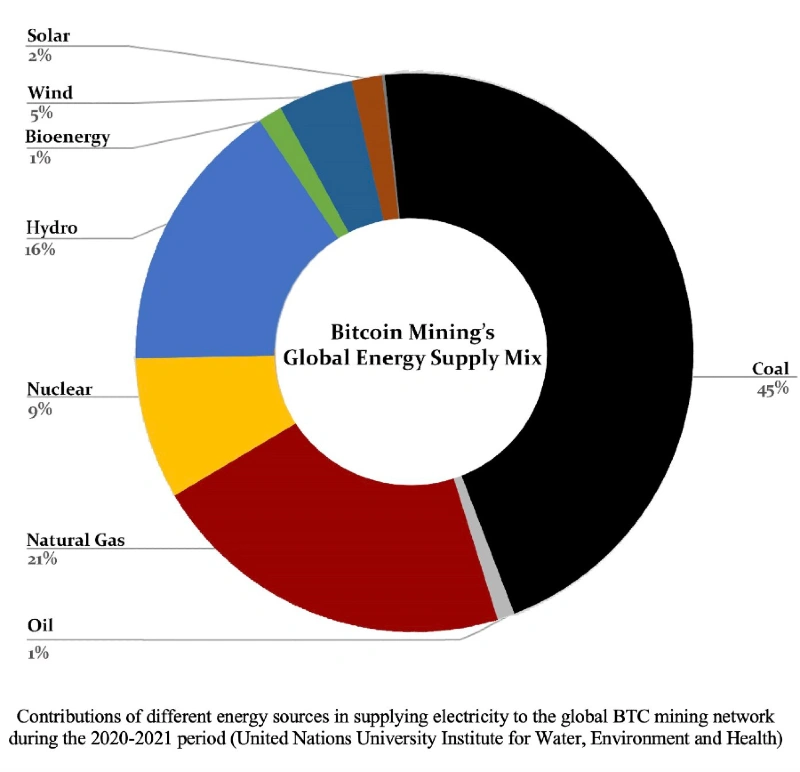

The study notes that approximately 67% of Bitcoin’s energy comes from fossil fuels, with coal representing 45% of this mix. This reliance on carbon-heavy energy sources resulted in Bitcoin mining emitting over 85.89 million metric tonnes (Mt) of carbon dioxide equivalent (CO2eq) between 2020 and 2021, which is analogous to the emissions from 84 billion pounds of coal burned or 190 natural gas-fired power plants.

The Bitcoin network’s carbon footprint isn’t merely a numerical value, but translates into a tangible impact on the environment. To put it into perspective, offsetting the CO2 emissions from Bitcoin mining during the aforementioned period would require the planting of approximately 3.9 billion trees, covering an area nearly equivalent to countries like the Netherlands, Switzerland, or Denmark, or 7% of the Amazon rainforest. This staggering figure brings into sharp focus the scale of the environmental debt incurred by Bitcoin mining.

Furthermore, geographical disparities in Bitcoin mining practices lead to varied environmental footprints.

For instance, the study emphasizes the dynamic landscape of mining, noting that China’s once-dominant position in Bitcoin mining has shifted due to regulatory actions, transferring some of the environmental load to other countries such as Kazakhstan and the United States. These shifts aren’t without consequence, as they alter the carbon footprint landscape depending on the energy mix of the hosting country.

For example, in Ireland, which ranks ninth in electricity use for Bitcoin mining, the carbon footprint is disproportionately high due to its reliance on fossil fuels for electricity generation.

The link between Bitcoin’s market price and its environmental impact is also highlighted in the research. A surge in Bitcoin prices correlates with increased mining activity and energy use. This was particularly evident in 2021 when a spike in Bitcoin prices led to a 140% increase in the global network’s electricity use.

The study illustrates this with a 77% correlation between Bitcoin’s price and its energy consumption over a specific period, underlining how market dynamics can lead to immediate and significant environmental impacts.

The discussion on carbon emissions isn’t just a technical one; it carries with it socio-economic dimensions. Countries with lower GDP per capita, which are also among the top in electricity use for Bitcoin mining, are disproportionately affected. This not only exacerbates existing inequalities but also imposes long-term environmental costs.

In light of these findings, the study calls for a suite of policy interventions and regulatory measures to manage the environmental impact of Bitcoin mining. These include increased transparency, economic tools such as taxes on cryptocurrency revenues, carbon offset mandates, and a ban on unclean energy-based crypto mining. Transitioning to sustainable mining practices isn’t only necessary for environmental conservation, but is also vital for the socio-economic stability of countries engaged in such activities.

Moreover, technological advancements like more energy-efficient mining hardware, and less energy-intensive blockchain validation protocols like proof-of-stake (PoS), are crucial to mitigating the environmental impact of cryptocurrencies. The study advocates for extensive research into the comprehensive environmental costs of the digital economy, urging stakeholders to consider the full spectrum of trade-offs associated with the transition to digital currencies.

Bitcoin’s carbon footprint is a multifaceted challenge that requires immediate attention. It’s an issue that goes beyond environmentalism, demanding a collaborative effort from governments, corporations, and individuals to ensure a sustainable future for both the economy and the planet.

The imperative is clear: as the world grapples with climate change, the unchecked growth of resource-intensive industries like Bitcoin mining must be addressed with urgency and innovation.

Water and Land Resources: The Hidden Casualties of Cryptocurrency Mining

The conversation about the environmental impact of Bitcoin often centers on its energy consumption and carbon emissions, but the cryptocurrency’s effect on the planet’s water and land resources is a lesser-known, yet equally critical issue.

According to a recent study, the global Bitcoin network’s water footprint was around 1.65 cubic kilometers (km³) in the 2020-2021 period—equivalent to filling over 660,000 Olympic-sized swimming pools, or more than the domestic water use of 300 million people in rural Sub-Saharan Africa. This staggering consumption highlights a vital aspect of the environmental toll exerted by Bitcoin mining that often escapes public discourse.

The issue with such a significant water footprint is multifaceted. On one hand, it competes with agricultural, industrial, and domestic needs, particularly in regions that are already water stressed. On the other, the energy sources that contribute to Bitcoin’s electricity generation—such as hydropower—have substantial water footprints themselves due to evaporative losses and other factors.

The study points out that hydropower is the dominant renewable energy source for Bitcoin operations, satisfying over 16% of the network’s demand, yet it’s not without its environmental trade-offs.

Land resources are similarly affected. The physical space required for the sprawling mining farms is just one aspect. The study found that the land footprint of the Bitcoin mining network across the globe in the 2020-2021 period covered more than 1,870 square kilometers, an area 1.4 times that of Los Angeles. This impact extends beyond the mere occupation of space. It affects wildlife habitats, local ecosystems, and can lead to deforestation and other forms of environmental degradation.

The dynamic nature of cryptocurrency mining further complicates these environmental impacts. As the study illustrates, the geographic shift in mining activities—from China to other countries like Kazakhstan and the United States due to regulatory crackdowns—can lead to significant changes in the environmental footprints of those regions.

Each country’s unique energy mix for electricity generation, which includes a variety of energy sources with differing water, carbon, and land footprints, influences the overall environmental impact of Bitcoin mining operations within its borders.

The research also emphasizes that the top 10 countries in terms of Bitcoin mining electricity use—many of which have GDP per capita below the global average—aren’t just leading in energy consumption, but also in contributing to the global water and land footprints. Unregulated and untaxed, these mining activities aggravate inequalities and could have lasting environmental impacts on these regions.

As such, the authors advocate for immediate policy, technological, and scientific interventions to mitigate these transboundary and transgenerational costs, which carry significant environmental justice implications.

Policy recommendations from the study include increasing the transparency of cryptocurrency mining operations and enacting a suite of economic and regulatory tools to limit and compensate for the environmental costs. These could involve taxes on cryptocurrency revenues and transactions, carbon offset mandates for blockchain tokens, and a ban on crypto-mining based on unclean energy.

In conclusion, while the energy consumption and carbon footprint of Bitcoin mining have been the focus of much scrutiny, the water and land footprints represent hidden casualties of the digital currency boom.

The study provides a clarion call to the global community to recognize and address these often-overlooked aspects of cryptocurrency’s environmental impact.

As we navigate the complexities of a burgeoning digital economy, it’s essential to balance innovation with sustainability, ensuring that our strides in technology don’t come at an unacceptable cost to our planet’s vital resources.

Geographic Disparities and the Shifting Landscape of Mining

The geographic distribution of Bitcoin mining activities has a profound impact on their environmental footprints, revealing stark disparities between different regions of the world. This dynamic landscape is constantly evolving, often in response to regulatory changes, electricity costs, and the pursuit of economic advantage.

The recent study provides a comprehensive view of how these geographic factors play a critical role in the environmental impact of cryptocurrency mining.

China’s once-dominant position in Bitcoin mining has notably declined, dropping from 73% of the global share in 2020 to just 21% by 2022 due to governmental bans targeting the practice. This regulatory shift has caused a significant migration of mining activities, primarily to countries like Kazakhstan and the United States, altering the global distribution of Bitcoin’s environmental footprint.

In the wake of China’s regulatory crackdown, the United States saw a 34% increase in its share of Bitcoin mining, and Kazakhstan experienced a 10% increase, reflecting a major shift in the landscape of cryptocurrency mining.

This shift also has implications for the environmental footprint of each country involved in Bitcoin mining. The study notes a reduction in the carbon, water, and land footprints of global Bitcoin mining as a result of changes in the geographic distribution and energy supply mix of mining activities. The global carbon footprint of Bitcoin mining, for instance, decreased by 34% within a year, highlighting the impact that changes in geographic mining patterns can have on environmental outcomes.

However, the study underscores that the global Bitcoin mining network remains heavily dependent on fossil fuels, with natural gas’s share in the global Bitcoin energy mix increasing from 15% in 2021 to 21% in 2022. This increase reflects the high dependency on natural gas for electricity generation in some of the top Bitcoin mining countries, presenting an ongoing challenge for reducing the environmental impact of cryptocurrency mining.

The disparities in the environmental footprints of Bitcoin mining aren’t just global, but also local. In the United States, for example, states such as Georgia, Kentucky, Texas, and New York have emerged as hotspots for mining operations, each contributing significantly to the country’s overall environmental footprint in this sector. The cost of electricity plays a crucial role in these geographic disparities, with areas offering cheaper electricity—often due to a reliance on fossil fuels—attracting heavier investments in Bitcoin mining.

The study’s findings present a complex picture of the transboundary and transgenerational costs associated with the unchecked growth of an innovative but “ungreen” economy. It calls attention to the fact that many of the countries leading in electricity use for Bitcoin mining have GDP per capita below the global average, are already struggling with social and economic justice measures, and are disproportionately affected by the environmental impacts of these activities.

In response to these challenges, the study advocates for immediate policy, technological, and scientific interventions. These interventions include increasing transparency in cryptocurrency mining operations, enacting economic and regulatory tools such as taxes on cryptocurrency revenues, and transitioning to more sustainable practices.

Additionally, the adoption of alternative blockchain validation protocols that are less energy-intensive, such as proof-of-stake, could significantly reduce the environmental footprint of cryptocurrencies.

As the digital currency sector continues to grow, the study emphasizes the need for a comprehensive evaluation of the transition to digital currencies and their associated environmental impacts. It calls for more research into the full spectrum of environmental footprints of cryptocurrency mining, advocating for high-resolution estimates and future growth projections that can inform sustainable practices and policy decisions.

As the world grapples with the challenges of climate change and resource availability, understanding and addressing the geographic disparities in the environmental impacts of Bitcoin mining becomes crucial for ensuring a sustainable future for the global economy.

The Ripple Effects of Bitcoin Value Fluctuations

The value of Bitcoin and its consequent mining viability is closely tied to its market price, which is characterized by pronounced volatility. This inherent instability of Bitcoin’s price has far-reaching implications, not only for investors and financial markets but also for the energy sector and the environment.

Throughout the last decade, the prices of major cryptocurrencies, especially Bitcoin, have witnessed substantial growth, which has increased the global trading volume and number of transactions significantly. The rapid adoption and integration of cryptocurrencies into the global financial system have amplified the demand for mining—the energy-intensive process of validating transactions and creating new coins.

As a result, the profitability of mining activities is closely linked to the fluctuations in Bitcoin’s value. When prices soar, the economic incentives to mine increase, leading to a proliferation of mining activity and a corresponding surge in electricity consumption.

A study analyzing the environmental footprint of Bitcoin mining across the globe reports that in 2021, when the price of Bitcoin increased by 400% compared to the previous year, the global Bitcoin network saw a 140% spike in electricity use. This spike isn’t just a statistic but translates into increased demand on power grids, heightened CO2 emissions, and other environmental impacts due to the energy-intensive nature of mining operations.

The price of Bitcoin is thus a significant driver of its environmental impact. For example, in Iran, the government attributed major blackouts to the surge in unregistered (and thus untaxed and unregulated) Bitcoin mining farms, reflecting the strain that increased mining activity can place on a nation’s energy infrastructure. The study emphasizes the complex interplay between financial incentives, energy consumption, and environmental sustainability in the context of cryptocurrency mining.

The correlation between Bitcoin’s price and its energy consumption is evident, with a 77% correlation observed over the period from January 2020 to December 2021. This strong correlation underscores the environmental risks associated with price-driven increases in mining activity. As Bitcoin prices rise, the allure of mining rewards draws more computational power into the network, increasing the total hashrate and, consequently, the energy demand.

The research further shows that the growth of Bitcoin and other cryptocurrencies involves a range of financial, political, security, and even criminal incentives that can motivate states, large corporations, and individual investors to invest in these markets. This complexity makes it difficult to precisely predict how price changes will affect energy consumption, but the trend is clear: as the market grows, so does the energy demand and the environmental footprint of mining activities.

Environmental footprints of global Bitcoin mining, as estimated in the study, reveal the heterogeneous environmental impacts across different countries. This unveils the unchecked growth of an innovative yet ungreen economy, particularly concerning since some countries leading in Bitcoin mining have GDP per capita below the global average and are already facing social and economic challenges.

Technological innovations that reduce the life-cycle impacts of the cryptocurrency network are also essential. For example, the study suggests the development and implementation of blockchain validation protocols that are secure but not as energy-intensive as Proof-of-Work, such as Proof-of-Stake, which could reduce the energy use per transaction and slow down the global cryptocurrency energy demand growth.

Towards a Sustainable Crypto Economy: Policies and Innovations

The environmental impact of Bitcoin mining has sparked a crucial dialogue about the sustainability of the crypto economy and the urgent need for policy intervention and technological innovation. The study underlines that to mitigate the environmental costs of cryptocurrency mining, a multifaceted approach is necessary, involving policymakers, the scientific community, industry stakeholders, and environmental advocates.

One of the study’s central recommendations is the implementation of regulations that mandate the use of renewable energy for mining operations. Currently, the Bitcoin network is highly dependent on fossil fuels, with coal accounting for a considerable share. By transitioning to renewable energy sources, the carbon footprint of mining can be significantly reduced.

However, renewable energy sources like hydropower also have environmental trade-offs, such as high water usage and land impact, which need to be considered. Therefore, the study suggests that any shift towards renewable energy should be assessed holistically to ensure it doesn’t inadvertently exacerbate other environmental issues.

Technological advancements play a critical role in this transition. The development of more energy-efficient mining hardware can decrease the amount of electricity required for mining activities. Furthermore, the adoption of less energy-intensive consensus mechanisms, such as proof of stake (PoS), could also lessen the environmental impact.

The PoS protocol, for example, validates transactions based on coin ownership rather than computational work, thereby reducing the need for energy-intensive mining activities.

The study proposes a suite of economic and regulatory tools to support these changes, such as taxes on cryptocurrency revenues and transactions, carbon offset mandates for blockchain tokens, and bans on crypto mining that relies on unclean energy sources. It also calls for divestment campaigns targeting environment-unfriendly digital currencies to discourage their use.

Moreover, the study emphasizes the importance of increasing the transparency of cryptocurrency mining operations. This could involve reporting requirements for the environmental impacts of mining activities, enabling better oversight and more informed policymaking. Such measures would help to account for the environmental costs of cryptocurrency mining and ensure that they’re factored into the price and profitability of mining activities.

In the broader context of the Fourth Industrial Revolution, the study highlights the need to consider the economic, environmental, and social trade-offs of digital currencies and other blockchain assets. While these technologies offer numerous benefits in terms of security, privacy, and efficiency, their environmental and social impacts must not be overlooked.

Finally, the study calls for more comprehensive research to evaluate the transition to digital currencies and their associated environmental impacts. Future studies should provide detailed estimates of the environmental footprints of cryptocurrency mining and project their growth, enabling the development of a sustainable digital crypto market.

The availability of high-resolution estimates and future growth projections is vital for policymakers to enact change and for individuals and companies to minimize the environmental footprints of their investments. Such knowledge is also crucial for protecting reputations and financial assets in a world where climate change and resource availability are increasingly pressing issues.

More To Discover

- Bitcoin Miners Triumph in Court, Shielding Energy Secrets. Why It Matters.

- Seaweed Farming for Carbon Dioxide Capture Poses Ocean-Sized Challenges in Scaling Up

- Greenhushing Trend Surges: Companies Shy Away from Touting Environmental Progress, Study Finds

- Carnegie Mellon Study Proves Grocery Delivery Is Less Sustainable than In-Store Shopping

In conclusion, the transition to a sustainable crypto economy requires concerted efforts to develop and implement policies and technological innovations that address the complex environmental challenges posed by cryptocurrency mining. With the right interventions, it’s possible to harness the benefits of cryptocurrencies while ensuring that their growth does not come at the expense of the planet’s health.

Source: Earth’s Future