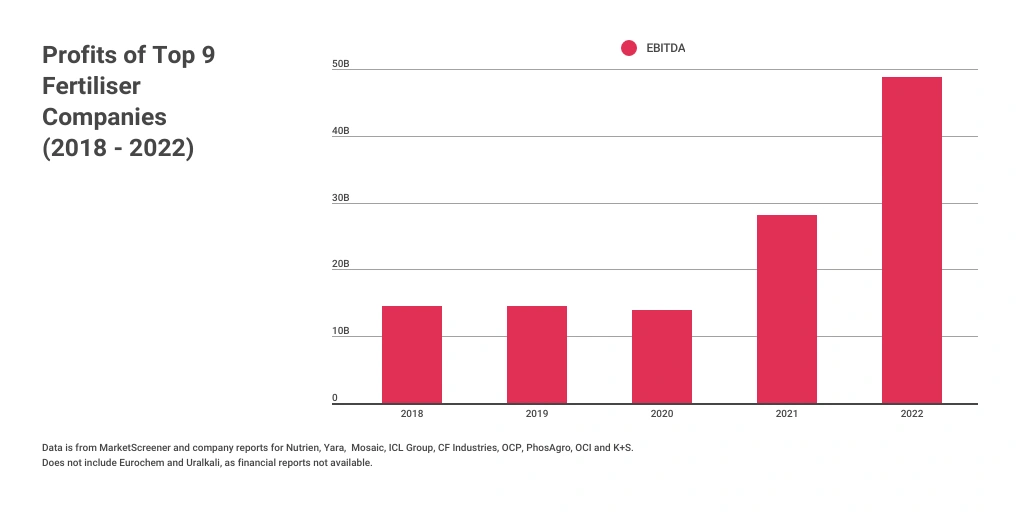

The financial results of the world’s largest fertilizer companies have just been released, and the numbers are shocking. While the cost of fertilizers skyrocketed in 2022, it was expected that these companies would see record-breaking revenues. However, the extent of their profiteering has taken everyone by surprise.

As farmers struggled with rising costs and the world faced a severe food crisis, these fertilizer giants not only ramped up their profit margins, but also more than tripled their profits from just two years ago.

The Power of Fertilizer Companies

The graph above illustrates the total profits of the top nine fertilizer companies over the past five years. These profits exponentially grew from an average of around $14 billion before the COVID-19 pandemic to $28 billion in 2021, and then an astonishing $49 billion last year.

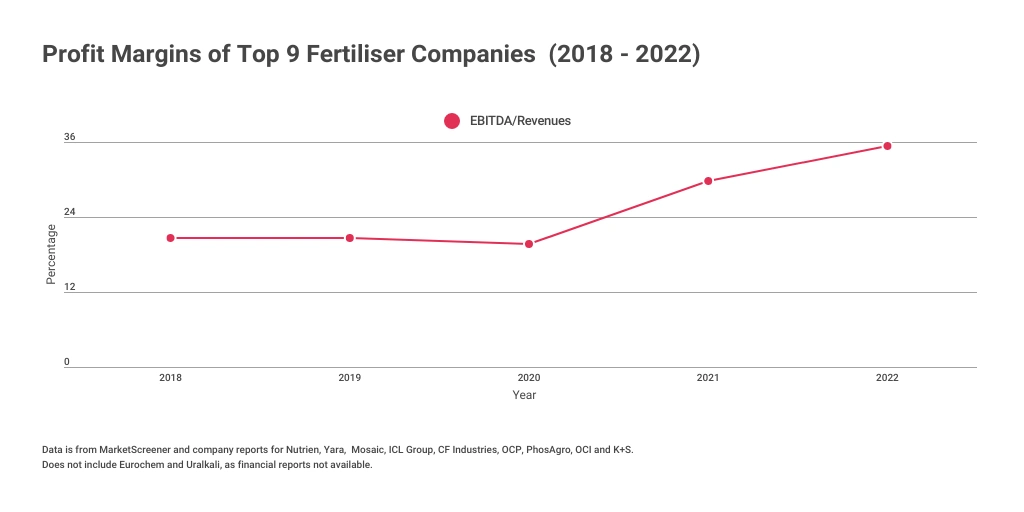

While international agencies partly blamed the spike in fertilizer prices on the Russian war in Ukraine and resulting shortages and trade disruptions, a significant part of the story lies in the monopoly power of these fertilizer companies. They increased prices far beyond the production cost increases, leading to a massive profit margin of 36% in 2022.

Who Are These Fertilizer Cartel Members?

Nutrien Ltd.: Nutrien, headquartered in Canada, is the world’s largest provider of crop inputs and services. It was formed through the merger of Potash Corporation of Saskatchewan and Agrium Inc. Nutrien produces and distributes a wide range of fertilizers, including nitrogen, phosphate, and potash products.

Yara International ASA: Yara, based in Norway, is a leading global fertilizer company specializing in nitrogen-based fertilizers. It has a strong presence in Europe, North America, and various other regions. Yara offers a broad portfolio of products and solutions for sustainable agriculture.

Mosaic Company: Headquartered in the United States, Mosaic is a prominent producer and marketer of phosphate and potash fertilizers. It operates mines and production facilities in several countries and distributes its products worldwide. Mosaic serves customers in the agriculture, animal feed, and industrial sectors.

CF Industries Holdings, Inc.: CF Industries, based in the United States, is a major producer and distributor of nitrogen fertilizers. It operates nitrogen manufacturing complexes in North America and distributes its products globally. CF Industries serves agricultural and industrial customers.

EuroChem Group AG: EuroChem, headquartered in Switzerland, is a global fertilizer company with a diverse product portfolio. It produces nitrogen, phosphate, and potash fertilizers and operates production facilities in Europe, Asia, and the Americas. EuroChem caters to agricultural and industrial markets.

OCP Group: OCP, based in Morocco, is one of the world’s largest phosphate rock and phosphate fertilizer producers. It holds significant reserves of phosphate rock and operates mines, processing plants, and distribution networks globally. OCP supplies a range of phosphate-based fertilizers.

ICL Group: ICL, headquartered in Israel, is a multinational manufacturer of specialty fertilizers and chemicals. It offers a wide array of fertilizers, including phosphate, potash, and specialty nutrient products. ICL serves customers in various sectors, including agriculture, industrial, and food markets.

The fertilizer cartel meets each year in Prague, usually in May. And judging from their website for this year’s event, the International Fertilizer Association knows they have a publicity problem connected with the obscene greed of their members.

Impacts on Farmers and Food Security

Although there are signs that fertilizer prices are decreasing from their astronomical heights earlier this year, the consequences of the price spike are still being felt.

High prices and limited supply in certain countries have forced farmers to reduce their fertilizer use, resulting in lower production levels and contributing to a concerning rise in global food insecurity. The inflated prices have also pushed many farmers deeper into debt.

From Cameroon to the United States, farmers are still spending three times as much on fertilizers as they were just a few years ago. Moreover, in countries where fertilizers are heavily subsidized, the price surge has burdened governments with substantial debts.

In India alone, the central government’s expenditure on fertilizer subsidies surged from US$9.8 billion to US$17.1 billion last year. Ultimately, it is the people who bear the brunt of the fertilizer industry’s price gouging.

Environmental Consequences

The costs are not limited to farmers and economies; the planet also suffers. Chemical fertilizers are a significant source of environmental pollution and greenhouse gas emissions, with nitrogen fertilizers alone accounting for one out of every 40 tonnes of annual emissions.

Recent reports from the UN’s Food and Agriculture Organization and Earth4All, a collective of leading scientists and economists, emphasize the urgent need for substantial reductions in global fertilizer use to avoid catastrophic climate change.

Both reports recommend a near phase-out of nitrogen fertilizer consumption by 2050.

The goal is not to abruptly crash production levels, but to plan a transition toward more sustainable and agroecological farming systems that require less or no fertilizer.

Recent reports from the UN’s Food and Agriculture Organization and Earth4All, a collective of leading scientists and economists, emphasize the urgent need for substantial reductions in global fertilizer use to avoid catastrophic climate change.

Both reports recommend a near phase-out of nitrogen fertilizer consumption by 2050. The goal is not to abruptly crash production levels, but to plan a transition toward more sustainable and agroecological farming systems that require less or no fertilizer.

Addressing Corporate Greed and Environmental Crisis

It is evident that today’s food inflation stems from both corporate greed and ecological breakdown. Excessive profit-taking by corporations across the food system, from fertilizers to processing to retail, is driving up prices.

Additionally, the way these corporations organize our food production and distribution contributes to climate change and undermines the global food system’s ability to provide affordable and accessible food in the short and long term.

More To Discover

Urgent Action and Transition

Bold new approaches are urgently needed to curb corporate power in the food system and address the ongoing food crisis. Policies like windfall taxes and price controls can help tackle profiteering in the fertilizer industry.

However, to effectively address both profiteering and environmental catastrophes, a transition away from heavy reliance on chemical fertilizers in food production is essential.

While the fertilizer industry may push for the opposite, farmers and rural movements worldwide are already leading successful transitions toward alternative fertilization methods.

What holds us back is the structural political change required at all levels to combat excessive profiteering in the fertilizer industry and chart a new path toward more resilient food systems.