In a landmark decision that marks a significant shift in global energy policies, the Group of Seven (G7) nations have pledged to conclude the era of “unabated” coal usage by 2035. This commitment was made public through a communiqué after extensive discussions among energy, climate, and environment ministers in Turin, Italy. They declared an intent to “phase out existing unabated coal power generation in our energy systems during the first half of 2030s,” an ambition long elusive in past G7 negotiations.

However, the specific use of the term “unabated” introduces flexibility in the timeline, permitting continued coal usage past the 2035 target, if carbon emissions are effectively captured and stored. Moreover, the agreement allows for adjustments based on individual country timelines that align with the global goal of capping temperature rise at 1.5°C, potentially enabling some nations to extend their coal dependency beyond 2035 if it fits within their broader net-zero strategies.

This nuanced language was crucial for reaching consensus, explained Italian Environment and Energy Security Minister Gilberto Pichetto Fratin. He emphasized that the agreement balances the urgent need to curb coal use with the economic and social stability of the G7 nations. “G7 countries undertake to phase out the use of coal, without jeopardizing the various countries’ economic and social equilibrium,” Fratin stated, addressing the caveats included in the agreement.

The G7’s approach contrasts sharply with previous positions, such as that expressed by UK minister Andrew Bowie, who initially indicated a straightforward end to coal use by 2035, without mention of exceptions. This softer stance has not dampened the spirits of many climate policy experts, who see this as a significant breakthrough. Jennifer Layke, Global Director for Energy at the World Resources Institute, hailed the decision as a beacon of hope: “Stamping an end date on the coal era is precisely the kind of leadership we need from the world’s wealthiest countries,” Layke remarked, underscoring the symbolic power of the G7’s commitment.

Yet, not all feedback is entirely positive. Climate Analytics has critiqued the 2035 deadline as insufficient to meet the 1.5-degree Celsius threshold. According to their analysis, G7 nations need to eliminate coal usage by 2030 and natural gas by 2035 to stay within safe global warming limits. “Many of these countries have already publicly committed to phase out dates ahead of 2030, and only have a small amount of coal capacity anyway,” explained Jane Ellis, head of climate policy at Climate Analytics.

Interestingly, the dialogue around a potential phase-out of natural gas didn’t make it into the G7’s announcement, a point Ellis highlighted with concern: “In the last decade, gas has been the largest source of the global increase in CO2 emissions, and many G7 governments are investing in new domestic gas facilities. This is absolutely the wrong direction to be heading in – both economically and for the climate.”

The decision comes in the wake of new regulations from the US Environmental Protection Agency, mandating nearly complete capture of emissions from coal-fired power plants by 2039, a move that aligns with the broader G7 framework.

While the G7 leads the charge in shaping global climate policy, its decisions resonate beyond its membership, potentially influencing the G20, which includes other significant emitters like China and India, as well as major fossil fuel producers like Saudi Arabia and Russia.

More To Discover

- Science Class or Beef Commercial? How the Beef Industry is Targeting Your Kids’ Classrooms

- Crypto Mining’s Huge Energy Bite: 2% of US Power With No Local Benefits

- Hawaii Bids Farewell to Coal, Embraces Future with Massive Battery Storage System (Powered by Oil)

- New Battery Tech Tackles Two Decarbonization Challenges At Once

Last year’s COP28 climate talks saw a global agreement to transition away from fossil fuels, yet the lack of a definitive end date for coal was viewed as a missed opportunity.

As the world looks to the G7 for leadership, the true test will be how these promises are implemented and whether the envisioned transition can occur swiftly enough to meet the urgent demands of climate science.

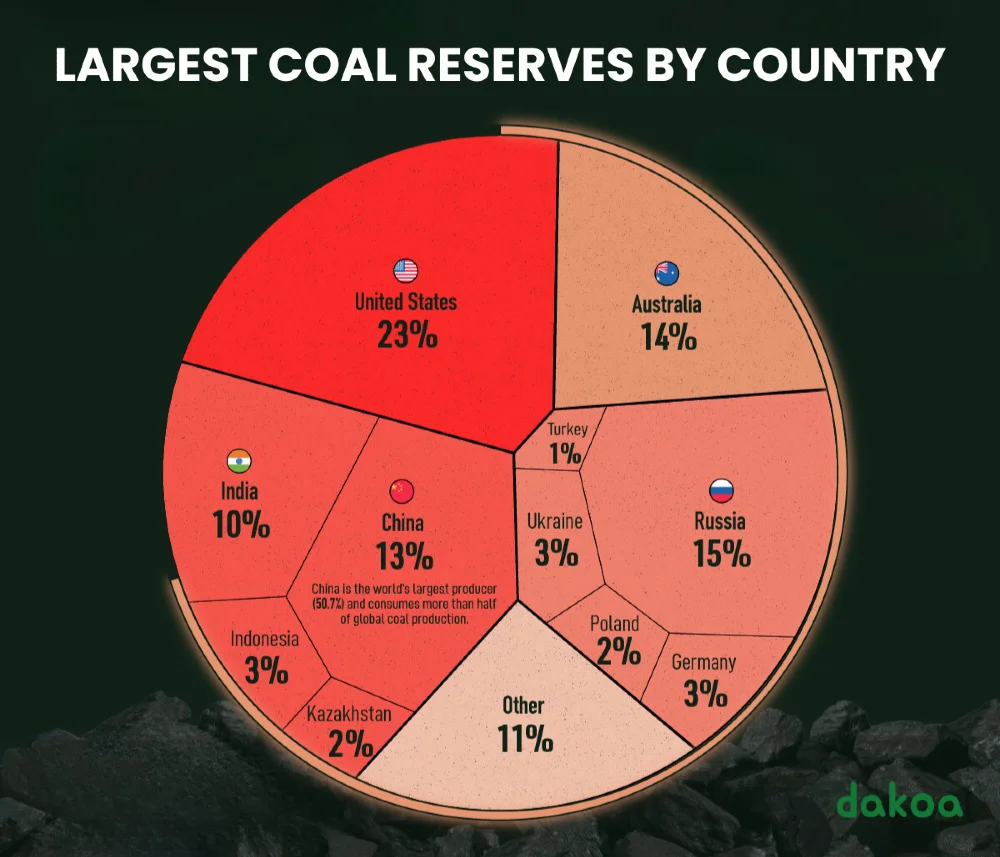

What Nations Rely The Most On Coal?

The following nations use the most coal when looking at their coal consumption in terms of both capacity (typically measured in total energy generation from coal or installed coal power capacity) and the coal industry’s economic significance.

- China

- Capacity: China is the world’s largest coal consumer, with a vast amount of installed coal power capacity. As of 2023, China has over 1,100 gigawatts of coal-fired power capacity.

- Economic Value: Coal plays a crucial role in China’s energy security and industrial sector, supporting major industries such as steel and cement manufacturing.

- India

- Capacity: India ranks second in coal consumption, with significant dependence on coal for electricity generation. It has over 250 gigawatts of coal power capacity.

- Economic Value: Coal is integral to India’s economy, providing a major source of power and being a key raw material for the utilities and manufacturing sectors.

- United States

- Capacity: The U.S. has been reducing its coal usage but still has significant capacity, with about 220 gigawatts of coal-fired power capacity. Not bad considering its size and energy requirements.

- Economic Value: While declining, the coal industry still supports electricity generation and manufacturing in various states, especially in coal-rich regions like Wyoming and West Virginia.

- Germany

- Capacity: Germany has been working on reducing its coal dependency but still maintains significant coal power capacity, roughly around 40 gigawatts.

- Economic Value: Coal remains a substantial part of Germany’s energy mix, especially for power generation and in heavy industries, though its role is diminishing due to aggressive renewable energy policies.

- Australia

- Capacity: Australia has a smaller population but is one of the largest coal exporters in the world. It has around 23 gigawatts of coal power capacity.

- Economic Value: Coal is a major export commodity for Australia, significantly contributing to the national economy through exports, primarily to Asia.

- Russia

- Capacity: Russia uses coal extensively for both domestic energy needs and exports, with significant coal power capacity.

- Economic Value: Coal mining is economically important in Russia, especially in regions like Siberia, contributing to both the local economies and the national export revenues.

- South Africa

- Capacity: South Africa relies heavily on coal for over 80% of its electricity generation, with significant coal power capacity.

- Economic Value: Coal is a key component of South Africa’s economy, not just for energy production, but also as a leading source of export revenue.

- Indonesia

- Capacity: Indonesia is another major coal exporter and consumer, with substantial amounts dedicated to domestic energy needs and export.

- Economic Value: Coal mining is crucial for Indonesia’s economy, providing jobs and being one of the top export earners.