The recent challenges faced by the residential solar sector, particularly in California, offer significant insights and warnings to the national landscape. High interest rates have been a major hurdle, diminishing the financial benefits for homeowners.

In California, the introduction of the net energy metering (NEM) 3.0 policy has further complicated the situation, leading to a significant drop in demand for rooftop solar installations. This has resulted in a sharp decline in major solar stock values and a substantial reduction in market demand, estimated between 40% to 80%.

California, previously a beacon of solar energy success, is now a case study in the complexities of solar policy impacts. At the PV Magazine USA’s Roundtables US 2023 event, a panel of solar and energy storage experts discussed these challenges. The panel included Carina Brockl from Aurora Solar, Blake Richetta from Sonnen, Walker Wright from Sunrun, and Bernadette del Chiaro from the California Solar and Storage Association (CALSSA).

Wright highlighted the pivotal role of net metering in catalyzing California’s solar market, which is a significant contributor to the U.S. rooftop solar sector. Del Chiaro pointed out the drastic sales drop, potentially up to 80%, under the new NBT tariff, casting a shadow on the future of the industry.

Despite these headwinds, there are still opportunities for growth.

Brockl noted that rising electricity prices, outpacing inflation, could make solar more appealing as a buffer against increasing utility rates, even if initial savings are minimal.

Richetta provided a more optimistic perspective, drawing parallels with Germany’s experience. After phasing out its supportive feed-in tariff policy, the German market initially contracted but later recovered, achieving high solar penetration rates. He emphasized the need to integrate solar into grid operations and transform it into a reliable energy source.

This scenario underscores the delicate balance between policy, market dynamics, and technological innovation in the solar industry. It also highlights the importance of learning from global experiences to adapt and evolve in a rapidly changing energy landscape.

Understanding California's NEM 3.0

Background on Net Energy Metering (NEM)

Net Energy Metering (NEM) is a critical policy mechanism that has historically underpinned the growth of rooftop solar in California. It allows solar panel owners to send excess electricity back to the grid in exchange for credits, which offset their electricity bills.

Introducing NEM 3.0

The new iteration of this policy, NEM 3.0, introduces significant changes. Unlike its predecessors, NEM 3.0 reduces the compensation rate for surplus solar energy fed back into the grid. Additionally, it introduces new fees and alters the billing structure for solar customers. These changes are designed to better align the policy with current energy market conditions and address concerns from utilities about the cost-sharing structure of the grid.

The revised compensation rates under NEM 3.0 are expected to reduce the financial savings for new solar panel installations. While previous versions of NEM made solar investments more attractive by offering substantial savings on energy bills, NEM 3.0 narrows this financial advantage. For homeowners, this means the payback period for solar panel installations could be longer.

How Long Does It Take For Solar Panels To Pay For Themselves in California?

There is no single-source answer to this question. It depends on multiple factors that are specific to you and your property.

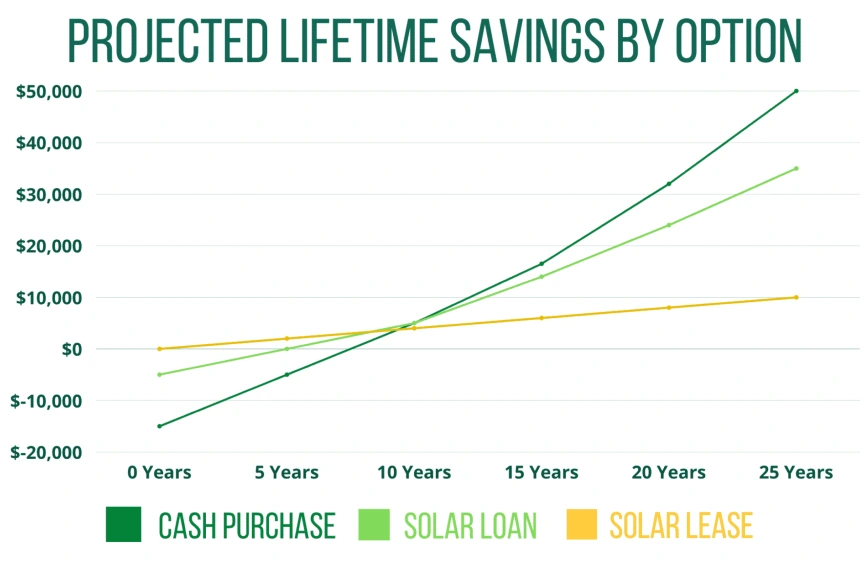

First, you must consider whether you purchased the panels outright, took out a loan, or are leasing.

Next, you need to look at your monthly energy consumption, the size of the system you need, the overall shading on your property, the net metering policy offered by your utility company, and of course, the total cost of installation and financing.

That said, most Californians find that their panels pay for themselves within 15 years.

Comparing NEM 3.0 to 2.0: What’s Different?

Comparing NEM 3.0 with previous policies and those in other states offers insights into its objectives.

Unlike NEM 2.0, which still provided considerable savings to solar users, the new policy aims to balance the financial load between solar and non-solar customers. This shift reflects a broader trend in solar policy, where the emphasis is moving from rapid adoption to sustainable integration into the energy grid.

Reactions to California’s NEM 3.0

The response has been mixed. Solar industry advocates argue that reduced incentives could slow down solar adoption, hindering California’s renewable energy goals. Utility companies, however, support the policy, stating it creates a fairer cost distribution for grid maintenance and operation.

More To Discover

- Why Renewables Can’t Save Our Planet And Are Actually Part Of The Problem

- MIT’s Solar-Powered Desalination System Could Produce Freshwater Cheaper Than Tap Water For Most Of The World

- Australian Solar Farm Closure After 7 Years Sparks U.S. Debate on Renewable Energy’s Waste Challenge

- Indonesia Celebrates Milestone with Southeast Asia’s Largest Floating Solar Power Facility for 50,000 Homes

Future Implications

The long-term effects of NEM 3.0 are yet to be fully realized. Its success in balancing grid maintenance costs with the growth of renewable energy will be a key factor in determining the future landscape of California’s energy policy. Additionally, how this policy influences residential solar adoption and California’s climate change mitigation efforts remains a crucial area to watch.