Bitcoin, the pioneering digital currency, has grown immensely popular for its decentralized nature and potential for high returns. Yet, beneath the surface of its lucrative appeal lies a lesser known but significant environmental concern: its rapidly growing water footprint.

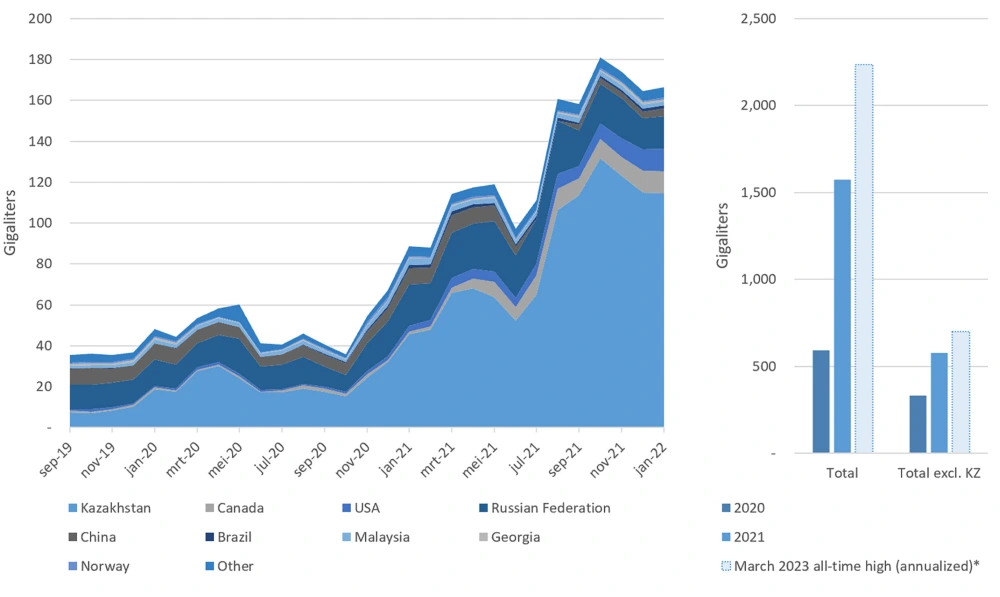

Shockingly, the annual water footprint of Bitcoin in 2021 surged by a staggering 166% compared to the previous year, escalating from 591.2 to 1,573.7 gigaliters. This increase is equivalent to the water footprint per transaction processed on the Bitcoin blockchain, soaring from 5,231 liters in 2020 to 16,279 liters in 2021. As we head into 2023, this number is projected to hit an alarming 2,237 gigaliters annually.

How much is a gigaliter of water?

A standard Olympic-sized swimming pool contains 2.5 million liters (2.5 ML) of water. One gigaliter (GL) equals 1,000,000,000 liters or 1,000 ML or, more succinctly, 1 billion liters. Meaning, 1 GL is enough water to fill 400 Olympic-sized pools.

1 GL is the equivalent of 264,172,052 gallons.

Alex De Vries, a data scientist with Dutch National Bank, has crunched the numbers and released his findings; every bitcoin transaction uses enough water to fill a swimming pool. Keep in mind that’s only a transaction, not the actual process of mining the bitcoin itself, which is what uses most of the water and electricity. De Vries data shows that each simple transaction on the Bitcoin network uses over 16,000 liters of water, or 4,226 gallons.

De Vries recently published a research paper with his findings that indicate what’s behind the massive usage of resources: a combination of miner cooling systems and the water consumption for miner energy sources.

Why The Change?

Bitcoin mining, the process of creating new bitcoins by solving complex mathematical puzzles, isn’t just an energy-intensive activity but also significantly water-intensive. The mining process involves two primary ways of water usage: direct and indirect.

The direct water footprint comes from the on-site usage of water in cooling systems and air humidification in mining facilities.

Indirectly, Bitcoin mining consumes water through the electricity generation needed to power the mining devices. A substantial part of this electricity is derived from thermoelectric power generation, which heavily relies on water for cooling.

The water consumption in Bitcoin mining is a critical issue, especially considering the current global water scarcity. Central Asia, including Kazakhstan, a key player in Bitcoin mining, faces a severe water crisis. In 2021, Bitcoin mining in Kazakhstan alone consumed 997.9 gigaliters of water. Since the nation’s capital is facing a yearly water shortage of over 75 gigaliters by 2030, the water requirements to mine crypto are horrifying.

What Can Be Done?

To mitigate this growing environmental concern, there are several approaches that Bitcoin miners can take. One effective solution is the use of immersion cooling, which involves immersing mining devices in a dielectric fluid, thus eliminating the need for water-based cooling. Another approach is to shift towards renewable energy sources like wind and solar power or thermoelectric power generation with dry cooling technologies, which don’t require freshwater.

A significant reduction in Bitcoin’s water footprint could also be achieved through changes in its software.

For example, Ethereum, the second-largest cryptocurrency by market capitalization, has demonstrated that modifying the underlying software can drastically reduce resource intensity.

Ethereum’s switch to a proof-of-stake mechanism in 2022 reduced its power demand by at least 99.84%, setting a precedent for Bitcoin to potentially follow.

As the world grapples with escalating water scarcity, particularly in regions heavily involved in Bitcoin mining, it’s imperative to address this issue head-on.

While Bitcoin continues to hold a prominent position in the digital currency market, it’s crucial to balance its economic benefits with environmental sustainability.

The steps taken by miners and the broader community towards reducing Bitcoin’s water footprint will be pivotal in ensuring a more sustainable future for both the cryptocurrency industry and the planet.

More To Discover

- Bitcoin Miners Triumph in Court, Shielding Energy Secrets. Why It Matters.

- The World’s Groundwater Crisis and the Pockets of Hope Defying the Trend

- Cryptocurrency and the Environment: In-Depth Study Examines The Hidden Costs of a Digital Gold Rush

- Self Sufficient Living: 5 Essential Skills You Need to Know

For those interested in delving deeper into the world of cryptocurrencies and their environmental impacts, please take a look at Cryptocurrency and the Environment: In-Depth Study Examines The Hidden Costs of a Digital Gold Rush.

Source: Cell Reports Sustainability