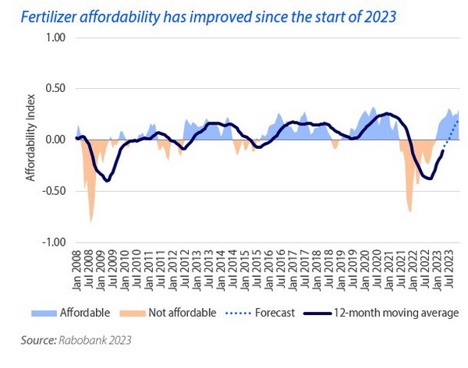

After experiencing extreme market volatility and record-high prices, the fertilizer industry is now witnessing signs of improved affordability, offering hope for a potential rapid recovery in consumption in certain regions in 2023.

However, it is anticipated that demand will take some time to fully return to pre-pandemic levels.

The fertilizer market faced significant challenges starting in the first half of 2021, with prices steadily increasing due to supply constraints caused by the Covid-19 pandemic.

Affordability deteriorated further when fertilizer prices reached unprecedented highs following Russia’s invasion of Ukraine. At that point, reasonable commodity prices were the only factor preventing affordability from surpassing the record set during the global economic crisis in 2009.

“Most fertilizer prices are gradually returning to their historical averages, and in some cases, such as urea, current values are already below historical levels,” explains Bruno Fonseca, Senior Analyst – Farm Inputs at Rabobank. “On the commodities side, values remain above average in some cases due to tighter stocks. The combination of these two factors is helping to improve affordability.”

Nonetheless, it is expected that global consumption will take two to three years to recover, with the pace of recovery dependent on the duration of the current positive cycle.

Outlook for Fertilizer Markets

Nitrogen-based fertilizers are known for their volatility, given their close ties to oil and natural gas markets. However, the need to replenish lost demand has driven urea prices downward, subsequently impacting ammonia prices.

The resulting price mismatch caused the ammonia/urea ratio to soar. It was only when natural gas prices started declining seasonally that ammonia prices followed suit, leading to a nearly halved ratio. A low ratio indicates greater stability in urea prices, as it serves as a proxy for production costs.

Global demand for urea is expected to benefit from this stability at current levels, gradually increasing throughout 2023 as it transitions from a sluggish state in 2022 to a healthier one in 2024.

In contrast to potash and nitrogen, phosphate prices experienced a significant surge last year following the conflict in Ukraine, despite the input’s lesser exposure to Russia.

Consequently, phosphate consumption saw a substantial and anticipated decline in 2022.

Despite weakened demand, prices remained elevated due to reduced Chinese exports.

As Chinese domestic consumption emerges from its peak season, there may be a return of Chinese volumes to the global market, depending on export parity, which could contribute to downward price movement.

More To Discover

- Wisconsin Scientists Innovate a Promising Solution to Extract Ammonia from Livestock Manure

- Texas A&M Researchers Explore Black Soldier Fly’s Potential in Tackling State’s Manure Issue

- Chipotle’s Investment in Cutting-Edge Agriculture and Fertilizer Tech Aims to Shed Greenwash Shadow

- Best Soil Boost: Cow Manure vs. Mushroom Compost

While potash prices continue to decline, this has not yet translated into increased demand. The market has reached a relative equilibrium, with sporadic periods of strong demand from Brazil and India.

However, even this demand has been unable to prevent potash prices from dropping due to ample supply.

Reports suggest increased market activity from Belarus despite sanctions imposed by the EU and the US. If Belarus expands its market share as expected, the resulting increase in exportable volumes would further drive down prices.

In summary, the fertilizer industry is witnessing a gradual improvement in affordability after facing significant challenges in recent years.

The market outlook varies across different fertilizer types, with urea expected to stabilize at current levels, phosphate prices potentially experiencing downward movement with the return of Chinese volumes, and potash prices remaining under pressure due to ample supply.

These dynamics will shape the recovery and future trajectory of fertilizer consumption in the coming years.