Every Friday, a bustling scene unfolds at the St. Onge Livestock auction, just outside the small town of St. Onge, South Dakota.

Ranchers from across the region gather to sell their cattle, and Justin Tupper, the owner and auctioneer, orchestrates the lively proceedings. This family business is a vital link in the beef industry, facilitating millions of dollars in sales on a single day.

The process is intricate but efficient. Cattle are brought in, tagged, and guided through a labyrinth-like system until they enter the sale barn. There, bidders, who are fellow ranchers, scrutinize the cows’ weight, breed, age, and external factors like the weather and futures market. The auctioneer, like Justin, leads the bidding with an energetic chant, creating a competitive atmosphere that drives prices up.

The auction is more than just a transaction; it is a price discovery mechanism. Through friendly competition, buyers determine the value of the commodity being sold. Small farmers and ranchers have relied on such auctions for decades, as they provide an open and fair platform for setting prices.

However, in the American beef industry, a lack of competition has disrupted this process, creating an unbalanced playing field.

The buyers and sellers at these auctions represent different stages of cattle ranching, each affected by the industry’s consolidation.

Matthew Kammerer, a cow-calf producer, breeds cows and raises calves on grass until they reach a certain age. These calves are then sold to backgrounder ranches, where they continue to graze until they reach a specific weight.

Finally, feedlots like Ted Thompson’s take in the cattle, known as finishing cattle, and prepare them for slaughter. The finished cattle are then purchased by meatpackers such as Tyson, JBS, Cargill, and National Beef, the dominant players in the industry.

This consolidation has had far-reaching consequences.

In the early 20th century, the meatpacking industry was highly concentrated, prompting public outcry over unfair practices and prices for farmers.

In response, the Packers and Stockyards Act of 1921 was enacted to ensure fair competition and protect farmers and ranchers. For several decades, the industry maintained a relatively balanced market, with the top four meatpacking companies controlling around 25 percent of the market.

However, a significant shift occurred in the 1980s when a conservative economic ideology influenced policymaking, including antitrust regulations.

This led to a permissive antitrust policy that allowed extensive mergers and acquisitions, particularly in the meatpacking industry. Over time, the top four companies increased their market share, reaching a staggering 85 percent control of all cattle produced in the United States.

The dominance of these four companies—Tyson, JBS, Cargill, and National Beef—creates a bottleneck between feedlot owners and meatpackers, exacerbating the lack of competition.

While consumers may perceive a range of brands, many of these companies have acquired smaller ones, creating an illusion of choice. Behind the scenes, the concentration of power stifles competition, impacts prices, and affects the entire supply chain.

When disaster strikes, the vulnerabilities of this structure become apparent.

Events like fires, plant closures due to the COVID-19 pandemic, or cyberattacks disrupt the industry’s operations. Meatpackers often reduce the prices they pay to ranchers while simultaneously increasing prices for consumers. The concentration of processing plants leaves little room for alternative options, intensifying the industry’s fragility.

The auction system, which fosters price discovery, largely excludes meatpackers. These companies prefer not to bid for cattle at auctions, but instead establish contracts directly with feedlot owners. This removes them from the competitive auction process, leading to reduced price transparency and fewer competitive bids.

Consequently, feedlot owners like Ted receive lower prices, which, in turn, impact the prices they can offer to backgrounder ranches and cow-calf producers like Brad and Matthew.

This trickle-down effect has contributed to the decline of cattle ranches, with approximately 40% going out of business since 1980.

Rural America has lost numerous small family businesses, eroding the legacy and independence associated with these ranches. The survival of these businesses is uncertain, and the challenges they face are only growing.

Efforts to address the lack of competition in the industry are underway.

Proposed solutions include reducing the number of contract sales between feedlot owners and meatpackers and making it easier for new meatpacking companies to enter the market. Enforcing antitrust laws that were originally designed to promote competition is another avenue being explored.

These measures aim to level the playing field, protect farmers and ranchers, and ensure a more competitive and resilient beef industry.

The current state of the beef industry highlights the intertwined relationship between consolidation, competition, and the well-being of farmers and consumers.

More To Discover

- Microplastics Are Basically Everywhere: Meat, Water, Produce, Packaging, Seafood And More. But Can They Really Hurt Us?

- Texas A&M Researchers Explore Black Soldier Fly’s Potential in Tackling State’s Manure Issue

- Hyped Tech-Driven Solutions to Climate Change Are Falling Short

- Oregon Announces Fishing Crisis due to Prolonged Commercial Fishery Failure (What We Learned From Their Mistakes)

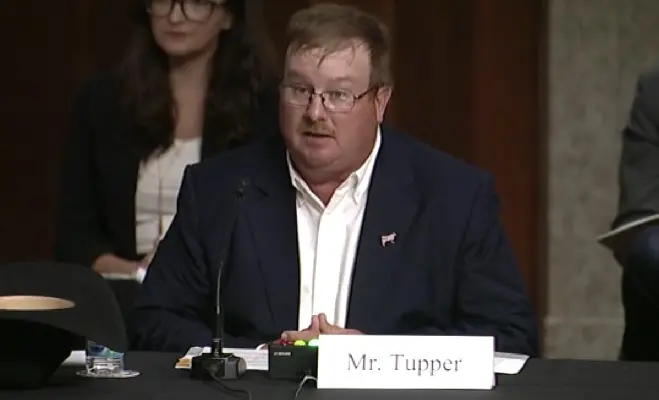

Justin Tupper testifies on cattle prices at Senate Agriculture Committee Hearing

The Senate Ag Committee held a hearing two years ago to discuss the issue of cattle market manipulation and anti-competitive practices by the meat packers.

Cattle producer and manager of St Onge Livestock Auction, Justin Tupper, testified that there’s a crisis in rural America.

“We are losing our producers at an alarming rate,” Tupper testified. “All the while watching big corporate feeders, packers, make record profits with the threat of vertical integration hanging over our head.”

Tupper went on to say they want the packers to make money because that’s what makes the system work. However, the differential between them and the packers is off.

“Since 2015, corporate packers’ gross margin ballooned from an average of 100 to 200 dollars a head to well over a thousand dollars a head. Packers have enjoyed unbelievable profits while cattle producers go out of business and consumers pay double or even triple at the meat counter.”

Tupper exlaimed that producers are not looking handout.

“We want a fair and equitable playing field, staffed by a referee with a whistle and a flag. Producers cannot be sustainable or generational without being profitable. Building a safe and secure food supply starts with ensuring the success of our food producers.”

This hearing in Washington D.C. took place in June of 2021. There has been no progress since.