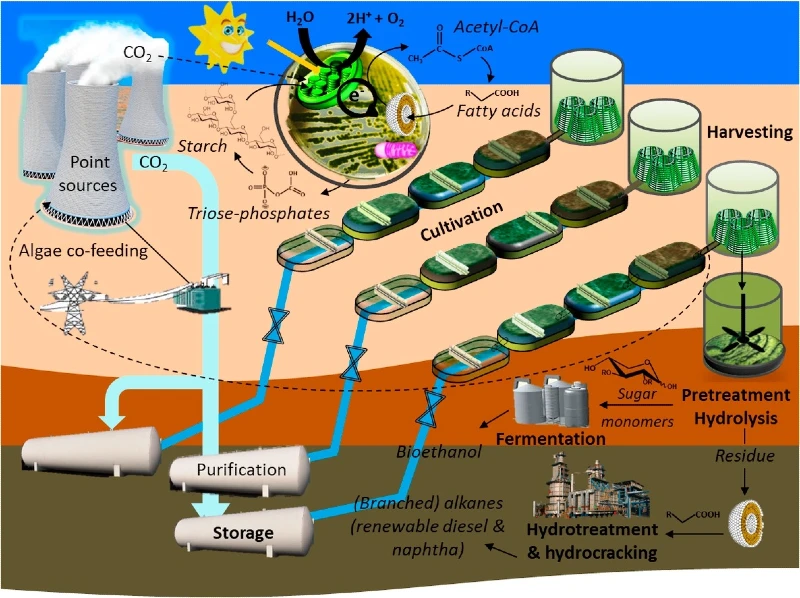

Once hailed as the future of green energy, algae biofuel was poised to revolutionize our fuel industry. With its eco-friendly promise and potential to cut down carbon emissions, algae biofuel had us all dreaming of a greener tomorrow.

But fast-forward to today, and the algae biofuel revolution seems more like a distant mirage.

Let’s dive into the intriguing world of algae biofuel, wading through the promises, pitfalls, and the somewhat sassy truth about why we’re not filling up our tanks with this green gold.

The Early Promise of Algae Biofuel Was Mostly High Hopes and Hefty Investments

In the early 2000s, algae biofuel was the poster child of renewable energy. The idea was simple yet revolutionary: cultivate fast-growing algae, extract its oil, and voilà – you have a sustainable fuel source! Governments and private investors were enamored.

From the U.S. Department of Energy’s millions in funding to private ventures like ExxonMobil’s $600 million investment in partnership with Synthetic Genomics, big names were betting big on algae.

The Allure of Algae Was Real, And Understandable

Algae biofuel wasn’t just another renewable energy fad. Its unique advantages set it apart:

- Rapid Growth: Some algae strains double their mass within hours.

- High Oil Content: Algae can yield much more oil per acre than traditional biofuel crops like corn or soybeans.

- Carbon Dioxide Munchers: Algae thrive on CO2, offering a way to reduce greenhouse gas emissions.

The Roadblocks and Reality Checks

Reality hit hard! Turns out, the cost of producing algae biofuel is staggeringly high – ranging from $300 to $2,600 per barrel. In comparison, fossil fuels are a steal. Why so pricey? Algae cultivation and processing are akin to running a high-tech farm and oil refinery rolled into one. Plus, the water and nutrient needs of algae are no joke.

Cost Comparison: Oil vs Algae Biofuel

The cheapest biofuel produced has come in at $300 a barrel, with the average price around $1,150. While oil production also has varying prices based on locations and types (onshore versus offshore, for example) even the most expensive barrel of oil produced doesn’t exceed $90.

- Onshore conventional oil operations are often less expensive, with costs varying widely depending on the region. In some Middle Eastern countries, the cost can be as low as $10 to $20 per barrel due to abundant reserves and relatively easy extraction methods.

- The costs for offshore drilling are generally higher due to the complexity and logistical challenges. Deepwater drilling can have costs ranging from $40 to $60 per barrel or more.

- Unconventional oil sources like oil sands, shale oil, and other forms require more intensive extraction and processing methods. For example, extracting oil from tar sands or through hydraulic fracturing (fracking) can have costs ranging from $40 to $90 per barrel, depending on the technology used and environmental regulations.

- Countries in the Organization of the Petroleum Exporting Countries (OPEC) often have some of the lowest production costs due to large, easily accessible reserves. Costs in these countries can be at the lower end of the spectrum, typically below $30 per barrel.

12 Reasons Why Algae Biofuel So Expensive?

- High Capital Expenditure: The initial setup costs for algae cultivation systems (photobioreactors or open pond systems) are substantial. These systems require specific materials and technology to create optimal growing conditions, which can be costly.

- Energy-Intensive Cultivation: Algae growth requires controlled environmental conditions, including specific light, temperature, and pH levels. Maintaining these conditions, especially in large-scale operations, consumes significant energy, contributing to higher costs.

- High Carbon Dioxide Requirement: Algae require carbon dioxide (CO2) for photosynthesis. Supplying sufficient CO2, especially in large-scale operations, can be challenging and expensive. It often involves capturing CO2 from industrial emissions, which adds to the complexity and cost.

- Harvesting and Processing Costs: Separating algae biomass from water and subsequently extracting oil from the biomass are energy-intensive and costly processes. These steps require specialized equipment and can consume more energy than the amount of biofuel produced.

- Water and Nutrient Needs: Although algae can grow in various water sources, including wastewater, the need for clean water and specific nutrients (like nitrogen and phosphorus) for optimal growth adds to the operational costs.

- Scaling Challenges: Scaling algae production from lab-sized operations to commercial levels while maintaining efficiency and quality is a significant challenge. Overcoming these hurdles often requires extensive research and development, which is expensive.

- Land Use: Although algae can be grown in non-arable land, the land still needs to be prepared and maintained. The cost of land acquisition and development can be significant, especially near urban areas.

- Technical Challenges: Issues like contamination from other microorganisms and maintaining the desired strain purity require ongoing monitoring and intervention, which increase operational costs.

- Research and Development Costs: The field of algae biofuel is still in a relatively early stage, requiring substantial investment in research and development to improve efficiency and reduce costs.

- Market Competition: Algae biofuel competes with more established and often subsidized fossil fuels, as well as other renewable energy sources, which currently have a more developed infrastructure and lower production costs.

- Regulatory and Policy Barriers: The lack of specific regulatory frameworks for algae biofuel production and the variability in policies across regions can hinder investments and increase the risk, thereby raising costs.

- Distribution and Infrastructure: The need for new infrastructure to distribute algae biofuel and integrate it with existing fuel systems can add to the overall cost of making it a viable alternative to traditional fuels.

Big Oil’s Big Bet: Were The Intentions Real or Greenwashed?

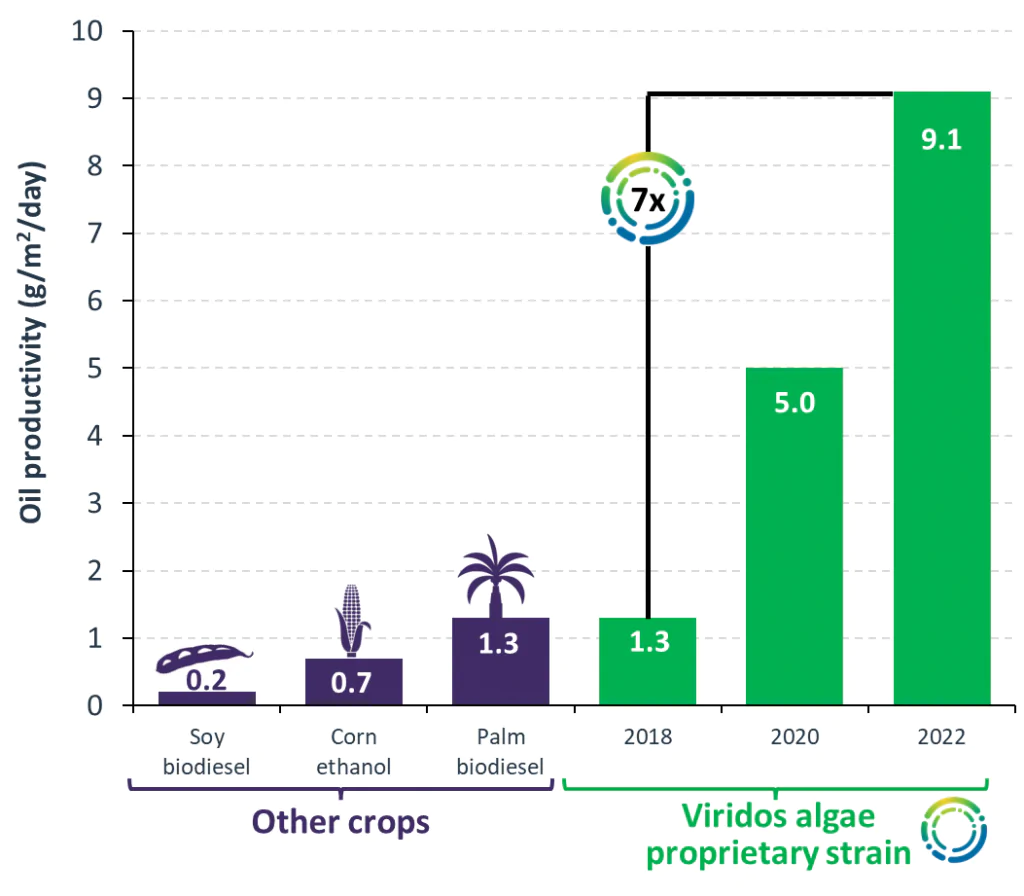

In the wake of ExxonMobil’s withdrawal from algae biofuel projects, Breakthrough Energy Ventures, spearheaded by Bill Gates, along with United Airlines and Chevron, have infused $25 million into Viridos, a California-based biotech company focusing on algae biofuels. This investment, announced in mid-March of this year, marks a notable shift in the biofuel industry, especially following ExxonMobil’s decision to end its algae biofuel endeavors late last year.

Algae-based biofuels offer a tantalizing prospect: replacing traditional liquid fuels like gasoline, diesel, and jet fuel without the agricultural drawbacks of alternatives like corn ethanol. This technology aims to bypass the significant land and water resources typically required, making it a more sustainable option.

Viridos is at the forefront of this innovative technology, working to elevate algae biofuels to commercially viable levels. Oliver Fetzer, CEO of Viridos, highlighted the company’s commitment to advancing biofuel technology that leverages saltwater to cultivate engineered microalgae, thus steering clear of the competition for crucial resources such as fresh water and arable land.

However, the path to realizing economically, and technically viable algae biofuels is fraught with challenges. ExxonMobil, a previous investor in Viridos and a significant player in algae biofuel research, concluded that the technology wasn’t yet ready for the market. This led to the company withdrawing support, resulting in substantial layoffs at Viridos and the cessation of funding for an algae research program at the Colorado School of Mines.

The impact of ExxonMobil’s departure was felt acutely in the research community. Matthew Posewitz, a chemistry professor at the Colorado School of Mines and a veteran in algae-based biofuel research, lamented the loss of ExxonMobil’s resources and collaborative efforts. Despite acknowledging the current non-viability of algae biofuels for commercial use, Posewitz remains optimistic, citing recent strides in identifying highly productive algae strains.

Nevertheless, significant technical hurdles persist, such as efficiently harvesting cells and the high costs of separating them from water. Furthermore, algae’s substantial carbon appetite poses another challenge, particularly when scaling up production. Microbial predators also present an obstacle in algae cultivation.

Posewitz remains hopeful about the future of algae biofuels, despite these challenges. He views the journey towards viable algae biofuels as a gradual, yet relentless pursuit of changing the world, acknowledging both the progress made and the difficulties that lie ahead.

Was ExxonMobil Just Greenwashing Us All?

ExxonMobil’s retreat from algae biofuel research has raised questions about the oil giant’s commitment to genuine climate solutions. The company’s decade-long algae research, which began in 2009, saw an investment of over $300 million — a figure that pales in comparison to Exxon’s annual expenditure on its core oil and gas ventures, which is projected to reach $24 billion in 2023.

Despite the significant investment in algae biofuel research, skeptics point to the relatively modest scale of funding in the context of Exxon’s overall budget. Moreover, the company’s heavy reliance on advertising its algae program, which cost $68 million, has drawn criticism. A congressional probe into the industry revealed this expenditure, leading critics to argue that Exxon’s biofuel investments were a more public relations exercise than a step towards establishing a commercial enterprise.

ExxonMobil Algae Ad

Richard Wiles, president of the Center for Climate Integrity, expressed skepticism about the algae program’s potential impact on climate solutions. He told Gas Outlook, “Even if they had achieved maximum success, it would be about 10,000 barrels per day. That would be the best-case scenario. It never could have made a contribution to climate solutions at the scale they were talking about. So, it was just clearly a part of their whole disinformation apparatus. Obviously, they used it primarily as a greenwashing tool.”

This sentiment was echoed by the findings of a congressional inquiry into climate deception by major oil companies. The House Oversight Committee’s memo from last year unveiled email exchanges and documents suggesting ExxonMobil was aware of the distant commercial viability of its algae investments while continuing to actively promote the program.

The Committee’s September 2022 memo stated, “This focus on advertising unproven technologies that may not scale for decades, if at all, suggests that these advertisements served to distract the public from Exxon’s continued fossil fuel business.”

ExxonMobil has since shifted its focus to other areas such as blue hydrogen and carbon capture and storage, buoyed by incentives in the Biden administration’s Inflation Reduction Act of 2022. Despite moving on from algae, ExxonMobil maintains that algae biofuel still holds promise as a renewable energy source.

Todd Spitler, a spokesperson for ExxonMobil, stated, “Algae still has real promise as a renewable source of fuel, but it has not yet reached a level we believe is necessary to achieve the commercial and global scale needed to economically replace existing sources of energy.” He highlighted that the company’s $350 million investment in algae over a decade yielded significant scientific advancements.

Former ExxonMobil Research Partner Praises the Oil Giant’s Contributions

Matthew Posewitz from the Colorado School of Mines had a distinctly scientific perspective on ExxonMobil’s involvement in algae biofuel research. He emphasized that his collaboration with Exxon scientists was strictly focused on the science, without any engagement in the company’s advertising efforts. “To us, it was always about science all the time,” Posewitz stated, reflecting on the research relationship with Exxon.

Looking ahead, Posewitz sees a more concentrated future for algae biofuels, particularly with the electrification of ground transportation narrowing the field of liquid fuels. This shift leaves a gap in sectors like aviation, where algae biofuels could play a crucial role. Posewitz believes that targeting these niche areas makes the challenge more manageable, potentially allowing algae biofuels to become a modest yet significant solution for climate change. “Because you’re going for a much smaller total quantity, it makes it way more practical. That it could actually deliver,” he explained.

However, Posewitz also recognizes the competition algae biofuels face from other technologies, like green hydrogen, in sectors such as aviation. The economic feasibility remains a critical factor, as he pointed out, “If it’s gonna be price competitive, it’s binary — it’s either cheaper or it’s not. And if it’s cheaper, everybody uses it, and if it’s not, nobody does.”

This pragmatic view aligns with the interests of Breakthrough Energy Ventures, which recently invested in Viridos, with a specific focus on sustainable aviation fuels. Their renewed interest suggests a strategic shift in the biofuels landscape, though both Breakthrough and Viridos have not commented.

Despite the potential, realizing the promise of algae biofuels would require substantial investment, possibly amounting to billions of dollars and decades of development. With ExxonMobil’s exit from the algae biofuel scene, the technology no longer serves as a component of oil industry advertising.

Reflecting on this shift, Richard Wiles from the Center for Climate Integrity remarked, “Now that Exxon’s out of it, and algae is no longer just a prop in their disinformation campaign, maybe we’ll get real research and figure out if this has any meaningful role at all. It’s not that algae is bad per se, although it looks like it’s a long way from meeting anything. It’s just the way [Exxon] used it that was so unethical.” This perspective underscores the need for genuine, ethically grounded research to explore the viability of algae as a sustainable fuel source.

Startups, Stumbles, Grants, and Growing Pains

The journey of algae biofuel from promising research to commercial application has been marked by notable startups, significant investments, and considerable challenges. Two companies, in particular, Sapphire Energy and Solazyme, stand out as early pioneers in this field.

Sapphire Energy

Founded in 2007, Sapphire Energy was one of the first companies to focus on algae-based biofuels. It raised substantial funding, including over $100 million in a Series C funding round in 2012. The company aimed to produce green crude from algae that could be refined into gasoline, diesel, and jet fuel. Despite its ambitious goals and significant investment, including backing from major investors like Bill Gates’ Cascade Investment and the Rockefeller family’s Venrock, Sapphire Energy struggled to scale its technology economically. By 2016, the company had shifted its focus towards algae-based food ingredients, reflecting the primal need to generate income in any way possible.

Solazyme (now TerraVia)

Solazyme, which later rebranded as TerraVia, was another early leader in algae biofuels. Founded in 2003, the company initially focused on producing renewable oils and biofuels from algae. Solazyme went public in 2011 and formed partnerships with large companies like Chevron. However, just like Sapphire, Solazyme encountered difficulties in scaling its biofuel production economically. The company eventually pivoted to producing algae-based food ingredients and specialty personal care products, before ultimately filing for bankruptcy in 2017. This pivot underscored the challenges in the algae biofuel market and the potential opportunities in other markets with higher profit margins.

The U.S. government, recognizing the potential of algae as a renewable energy source, has provided considerable support through various funding initiatives. The Department of Energy (DOE), for instance, has invested in algae biofuel research through programs like the Bioenergy Technologies Office (BETO).

For example, in 2014, the DOE announced funding of up to $25 million for the Algae Biomass Yield, Phase 2 (ABY2) program, aimed at supporting projects that could demonstrate improvements in algae biomass productivity.

However, translating these research grants into commercial-scale biofuel production has been a complex and elusive goal. In fact, to this day, no one has achieved success on the level required to push algae biofuel to the mass markets.

While the industry has seen its share of setbacks, the DOE and private investors are still funding ongoing research with the continued belief in the potential of algae as a sustainable energy source, albeit with a recognition of the hurdles that still need to be overcome.

More To Discover

- Green Energy Breakthrough: South Korean Researchers Pioneer Algae-Based Hydrogen Production

- U.S. Launches First Car-Ready E-Fuel With 1 Billion Liters in Production

- LanzaJet’s Sustainable Plant In Georgia Will Produce 10 Million Gallons of Eco-Friendly Jet Fuel to Tackle Airline Emissions

- Enviva In Crisis: Dissecting the Inevitable Collapse of Biomass Energy’s Biggest Player

Algae biofuel may find its niche in sectors like aviation, where high-energy-density fuels are essential, and electric alternatives are impractical. Continued research, especially in genetic engineering and cultivation techniques, could yet make algae biofuel a viable option.

Algae biofuel, with its tantalizing promise of a sustainable, eco-friendly energy source, captured our imaginations and investment dollars. Yet, the reality of high costs, technological hurdles, and environmental concerns has dampened the initial enthusiasm.

While not the energy panacea we once hoped for, algae biofuel’s story is far from over. It remains a field ripe for innovation, holding lessons for future green energy ventures and reminding us that the road to a sustainable future is often longer and more complex than we anticipate.